Overhead Rate Formula and Calculator

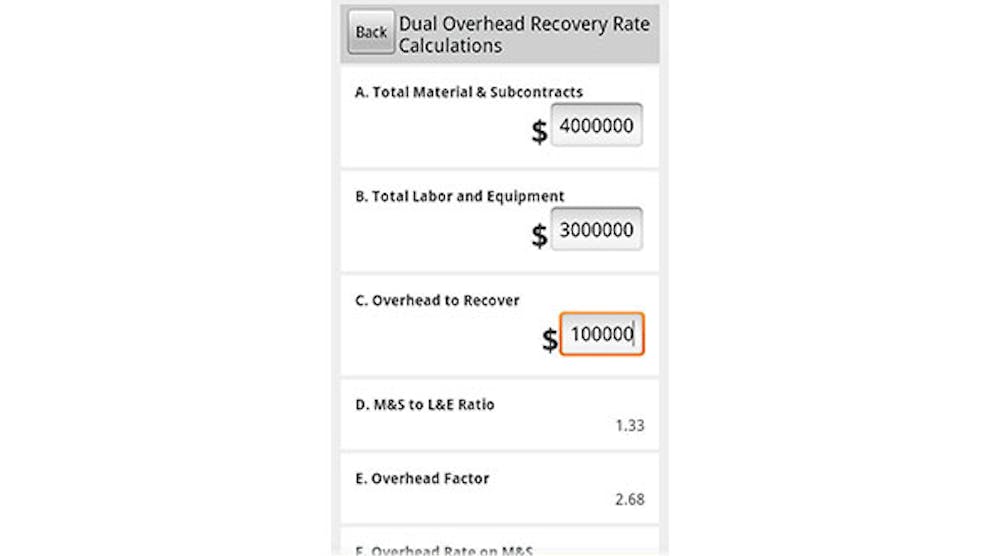

Overhead allocation calculator app EC&M

"The labor cost overhead recovery method adds an estimated flat dollar amount to your labor rate to ensure your overhead is covered in your pricing," he says. "This method works well if you have a company with relatively consistent material, equipment or subcontracting requirements across different types of jobs."

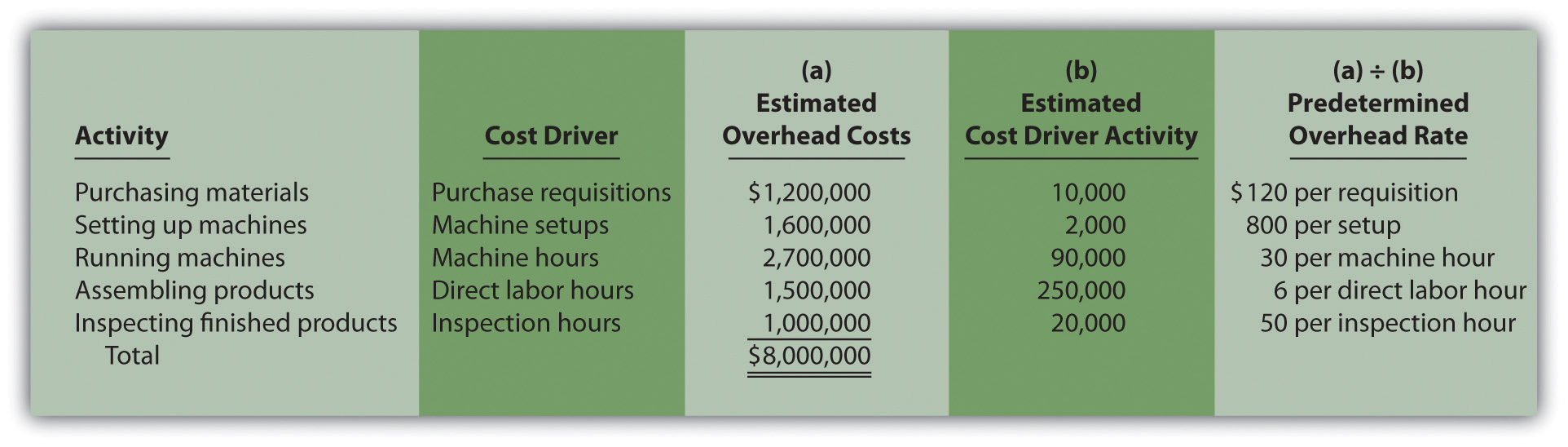

Using ActivityBased Costing to Allocate Overhead Costs

This is called the overhead absorption or recovery rate. Estimated overheads are absorbed into the cost of production, in order for money to be recovered from customers to pay the actual overheads. The rate is sometimes referred to as a recovery rate and sometimes an absorption rate, so it's important to realise that they're the same.

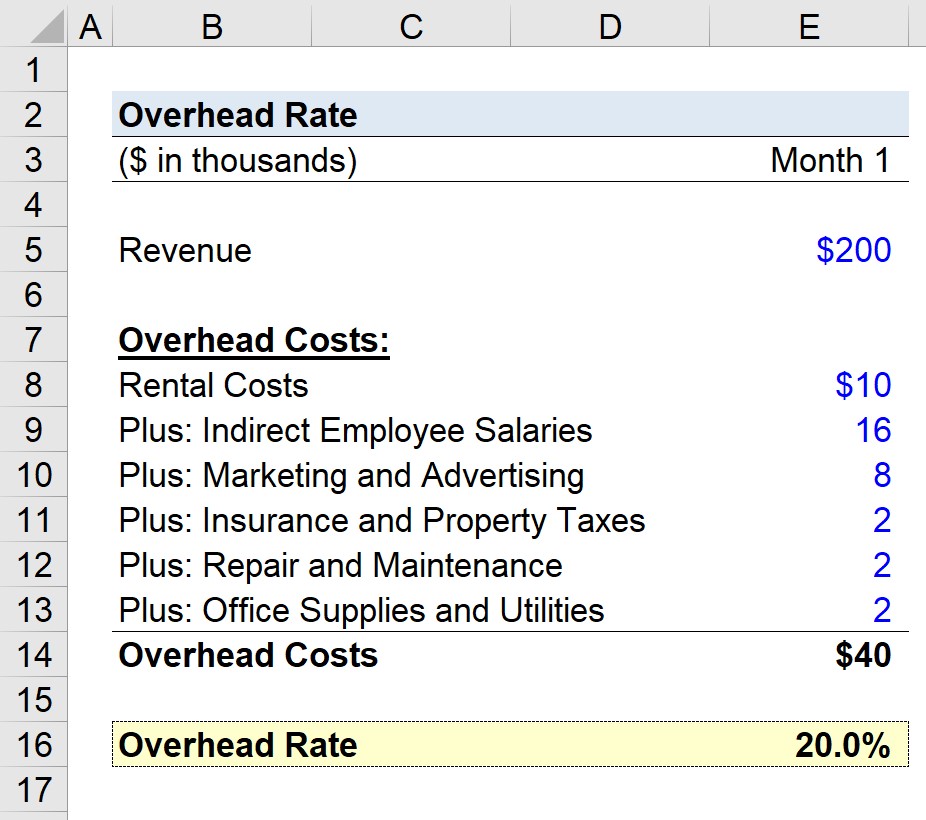

Overhead Rate Formula and Calculator

The overhead rate is a cost added on to the direct costs of production in order to more accurately assess the profitability of each product. In more complicated cases, a combination of several.

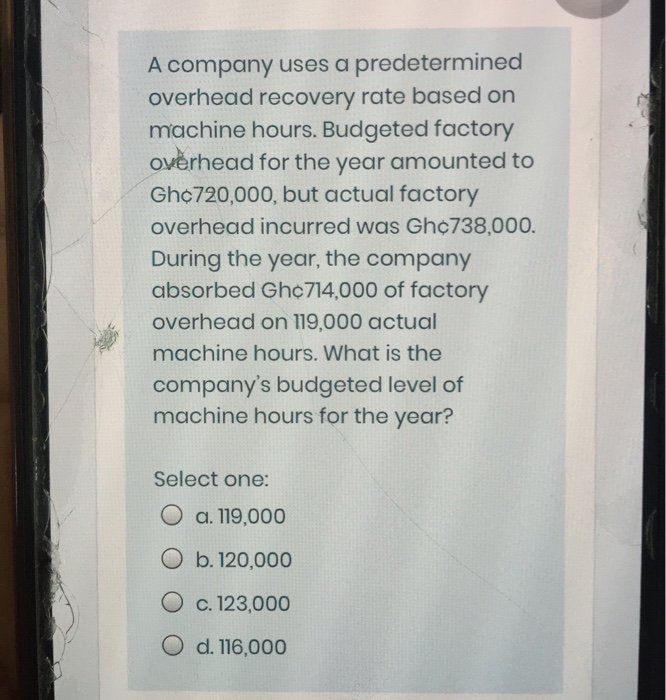

Solved A company uses a predetermined overhead recovery rate

It does not arrive at a daily overhead rate. Rather, it uses the as-bid HOOH rate times the cost of work performed during the delay period to determine the overhead used. Using the information above, we have the following. $7,112,274 x 100% = $6,646,985 107%.

Overhead Allocation Predetermined Overhead Rate YouTube

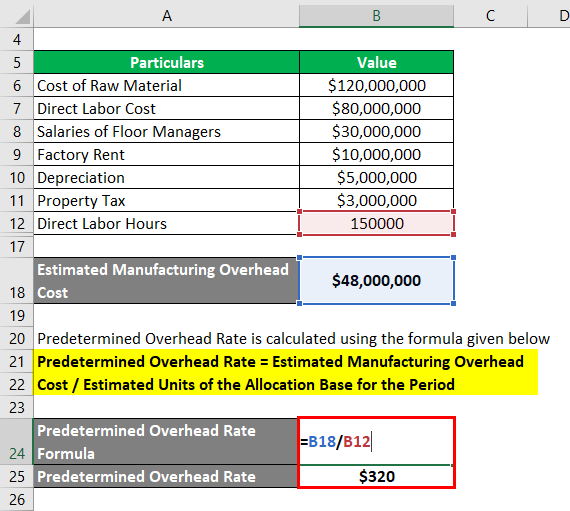

Predetermined Overhead Rate formula = 50000/10000 hours = $ 5/Labor hr. These are found using assumptions and are not accurate. The differences between the actual overhead and the estimated predetermined overhead are set and adjusted at every year-end. The adjusted overhead is known as over or under-recovery of overhead. Advantages

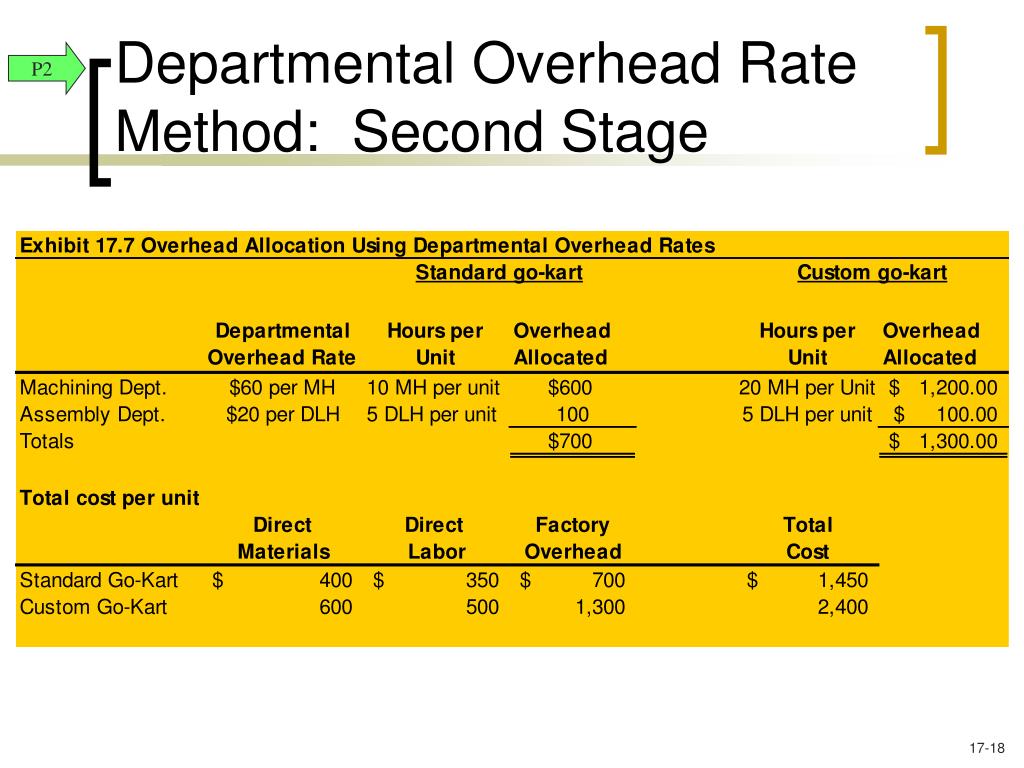

PPT Chapter 17 PowerPoint Presentation, free download ID6676007

Overhead Recovery Rate in Construction: Understanding its Significance and Calculation. In the construction industry, managing costs is a crucial aspect of successful project execution and overall financial health. Overhead costs, also known as indirect costs, are essential for running the business but cannot be directly allocated to a specific.

Predetermined Overhead Rate Formula Calculator (with Excel Template)

Specifically, the overhead recovery rate helps managers determine which fixed costs are not driven by volume or the number of goods sold. Figure out the total overhead costs for the organisation. Overhead costs are defined as those costs which are not directly associated with labour, such as salaried employees, utilities and rent.

1 Overhead Recovery Rate & Under/Over Absorption (BL AGRAWAL) For B. Com. & other course

If overhead costs are $245,000 and the cost of goods are $529,000, then the overhead recovery rate would be 47 percent ($245,000 / $529,000 = .4631 or 46.31 percent). To simplify, round up and use 1.5 as the rate to conclude the business must recover an additional 50 cents for every dollar of direct costs.

Accounting for Overheads Allocation, Apportionment and Absorption rate AAT YouTube

Overhead Recovery - this is the amount of overhead (company operating expenses) that you will recover on this project. We discussed three different methods of recovering overhead earlier in this course. 3. Net Profit - you need to price your jobs so that your business earns a profit. Build profit into your pricing plan so that you are planning

Overhead Recovery Rate Calculator Double Entry Bookkeeping

Learn how to calculate overhead recovery rate with this easy-to-follow tutorial. This video will walk you through the steps to accurately calculate your over.

Predetermined Overhead Rate Double Entry Bookkeeping

The Overhead Rate represents the proportion of a company's revenue allocated to overhead costs, directly affecting its profit margins. How to Calculate Overhead Rate? Overhead costs represent the indirect expenses incurred by a company amidst its day-to-day operations.

PPT Chapter 17 PowerPoint Presentation, free download ID6675733

Hub Accounting April 18, 2023 Running a business requires a variety of expenses to create your product or service, but not all of them will directly contribute to generating revenue. These indirect costs needed to keep your business going are called overhead costs.

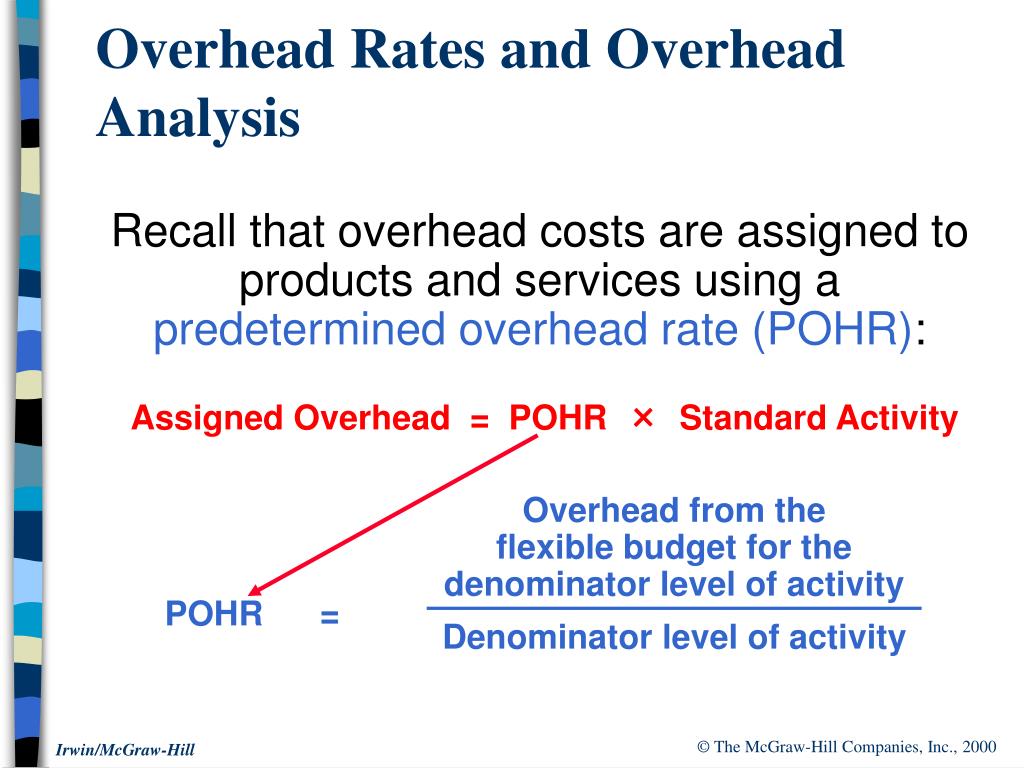

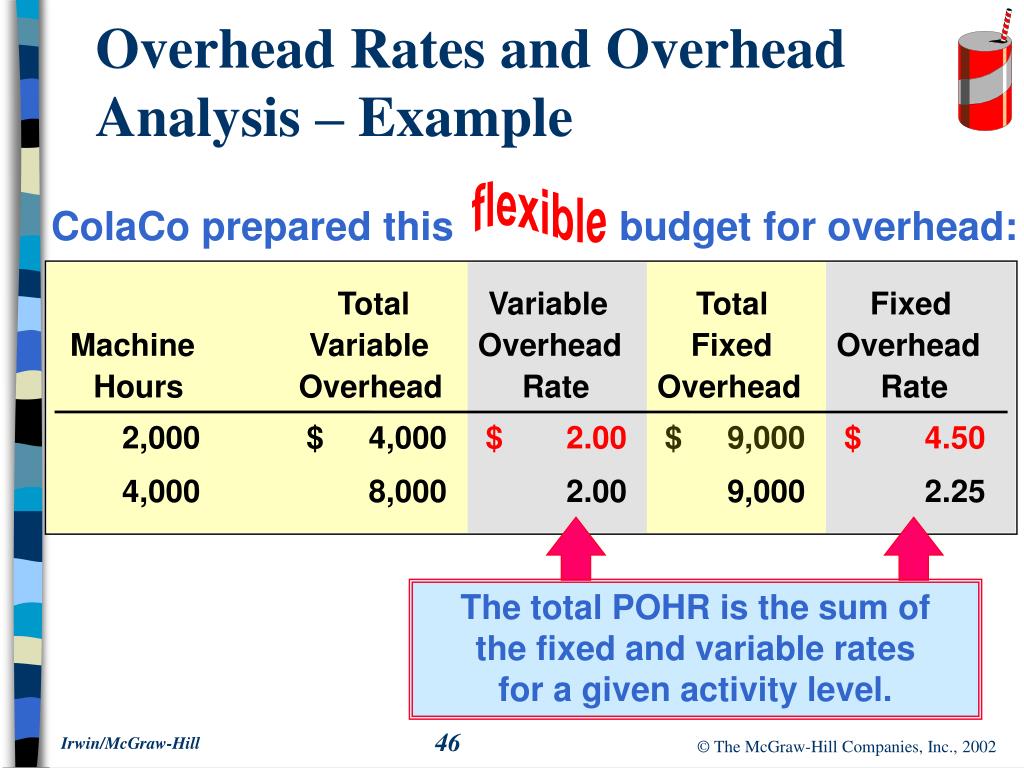

PPT Flexible Budgets and Overhead Analysis PowerPoint Presentation, free download ID4728955

The overhead rate, sometimes called the standard overhead rate, is the cost a business allocates to production to get a more complete picture of product and service costs. The overhead.

PPT Flexible Budgets and Overhead Analysis PowerPoint Presentation, free download ID6814165

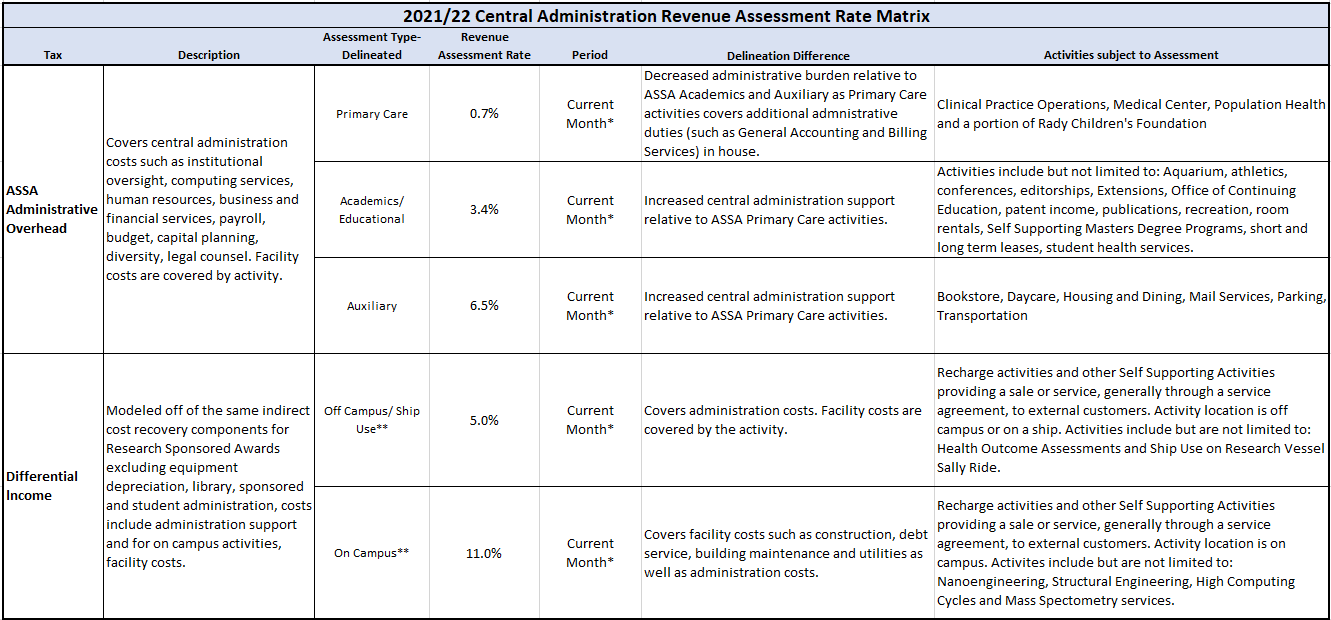

The overhead cost recovery rate, also referred to as Differential Income, is the rate applied to all sales to non-UC users of activities in order to recover the Indirect Costs related to the activity. Overview

Overhead Cost Recovery Differential

"When pricing or bidding a job, it is necessary to figure that for every dollar spent on the cost of goods sold, an additional percentage must be added to recover the overhead or fixed operating expenses that cannot be included in the bid." Read the full article

Overhead Recovery Analysis Excel Spreadsheet Software Business Accounting

Overhead costs is recovered at a rate of $19.75 per labor hour ($320,000 ÷ 16,200), which when added to the $47.54 labor rate, results in a rate of $67.29 per hour. Tying overhead to equipment revenues can be done in a number of ways. For our purposes, let's calculate overhead cost recovery at a flat rate of $3.37 per machine hour ($320,000 ÷.