Benefits of a Private Family Trust in India InCorp Advisory

Forrester Family YouTube

Contact information THE FORRESTER FAMILY TRUST. Charity number: 1190231 Charity reporting is up to date (on time) Skip to Content. Charity overview What, who, how, where Governance Trustees Financial history Assets and liabilities Accounts and annual returns Governing document Contact information.

Why Setting Up a Family Trust Matters EPPL

Forrester Family Trust We support excellent smaller charities to unlock change for people facing significant disadvantage. More about us Each year, we award grants across four categories: Grant theme Our theme for the year ended 31st March 2024 was Immediate Needs as a Result of the Cost of Living Crisis.

Forrester family in garden Culture Waitaki

THE FORRESTER FAMILY TRUST Charity number: 1190231 Charity reporting is up to date (on time) Charity overview What, who, how, where Governance Trustees Financial history Assets and liabilities.

Family Trust

The family trust needs to be signed by the settlor. After the trust is signed, the trustee (s) must hold a meeting agreeing on their appointment as trustee (s) of the trust. The trustees will choose to accept and be bound by the terms of the trust deed. We recommend conducting this step in a formal setting.

To Family Trust or Not? Boscia Financial Group

About the Forrester Trusts We've been helping small charities work towards a just and equitable society since 1986. The Trust owes its existence to the generosity of the Forrester family, Donald and Gwyneth, together with their daughter Wendy who continues to act as a trustee to this date.

Benefits of a Private Family Trust in India InCorp Advisory

o Funder: The Forrester Family Trust (founded in 2020 as a merger of the Donald and Gwyneth Forrester Trusts. Charity number 1190231. Total charitable expenditure for the year ended 31 March 2022: £1,494,223). o Who can apply: registered charities in England and Wales with an annual income of under £5 million.

Finding Forrester (2000)

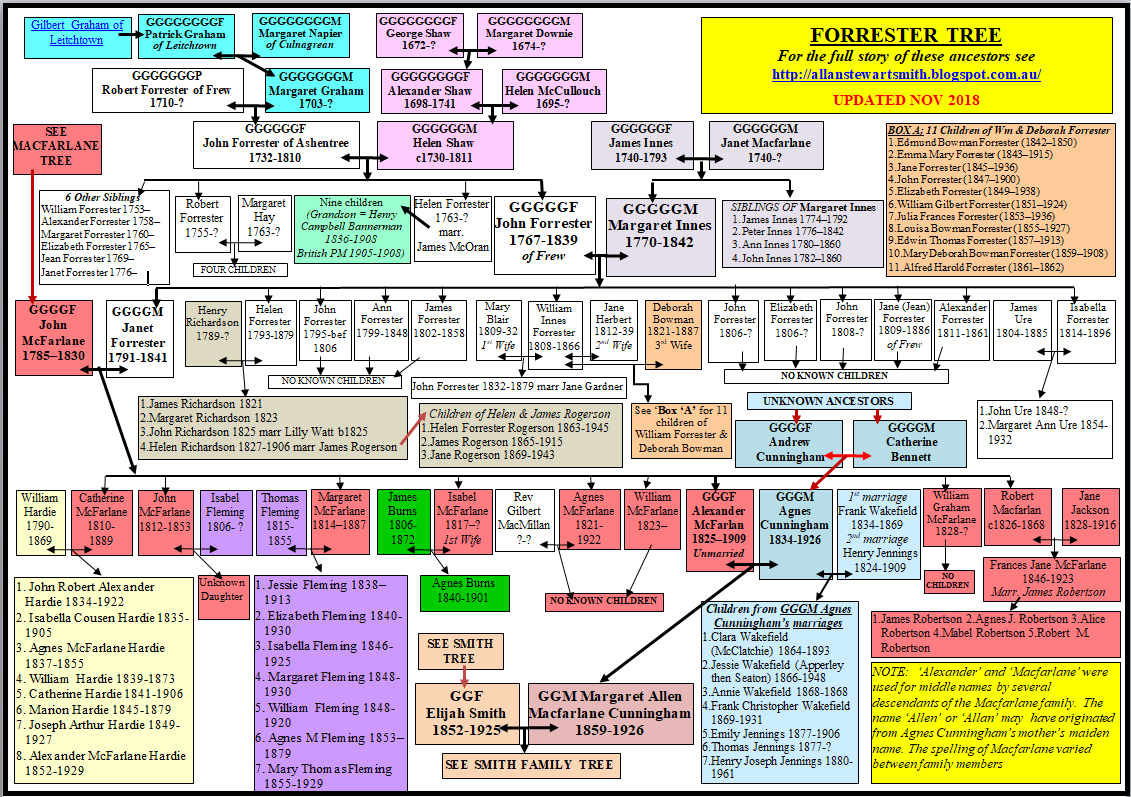

Forrester Family First Generation (In Australia) Robert Forrester born 1758 was convicted for stealing 6 sovereigns (6 pounds and 60 pence) on 29th April 1783. He was found guilty and given the death penalty (hanging) by Mr. Justice Nares at the Old Bailey in London.. Forrester owned and trained two Melbourne Cup winners, Gaulus in 1897, and.

The English & Scottish Ancestors of Allan Stewart Smith PART FIVE THE FORRESTER FAMILY TREE

We will make £1.5m available to small charities in our year ending 31st March 2024. Application windows are as follows: Themed Grants: 1st - 31st July 2023 Small Grants: 1st - 30th September 2023 We will aim to have grants distributed with three months of

Finding Forrester (2000)

THE FORRESTER FAMILY TRUST Charity number: 1190231 Charity reporting is up to date (on time) Charity overview What, who, how, where Governance Trustees Financial history Assets and liabilities.

Photos Bold & Beautiful’s Forrester Family

Forrester Family Trust The trust aims to fund projects which improve the quality of life for individuals and families. They take a broad view of what is meant by 'quality of life' and specifically look for interventions in places where people and communit.

Pin on The Bold and The Beautiful

The Forrester Family Trust's Small Grants programme, which opened to applications on Monday 1st July 2022 provides grants of up to £5,000 these grants to charities who rely on volunteer support and make an impact in their communities. The Trust makes awards against its 4 following priorities: 1.

Forrester's Zero Trust Framework YouTube

THE FORRESTER FAMILY TRUST Charity number: 1190231 Charity reporting is up to date (on time) Charity overview Activities - how the charity spends its money Charitable foundation. Income and.

Verify your Business Customers with bronID

These grants are available up to a maximum of £10,000 and will be made to charities with a turnover of less than £250,000. Online applications will be accepted between 1 and 30 September 2023. We have £500,000 to distribute. We aim to award these grants to charities who rely on volunteer support and make an impact in their communities.

What is the difference between a Family Trust and a Unit Trust YouTube

Step 7: Activate Your Family Trust and Ensure Compliance. Now it's time to set your family trust in motion. Put your plan into action: manage trust assets, generate income, and distribute profit as laid out in the family trust deed. Keep accurate financial records and fulfill tax obligations in line with regulations.

Family Trust for private assets Creatrust

Trust . We are trustworthy and trust our grantees. Compassion . We care and want to drive improvement . Our Four Priorities in more detail. Improve the quality of life of individuals and families. We will: Have a broad view of what quality of life means and the range of ways in which quality of life can be improved.

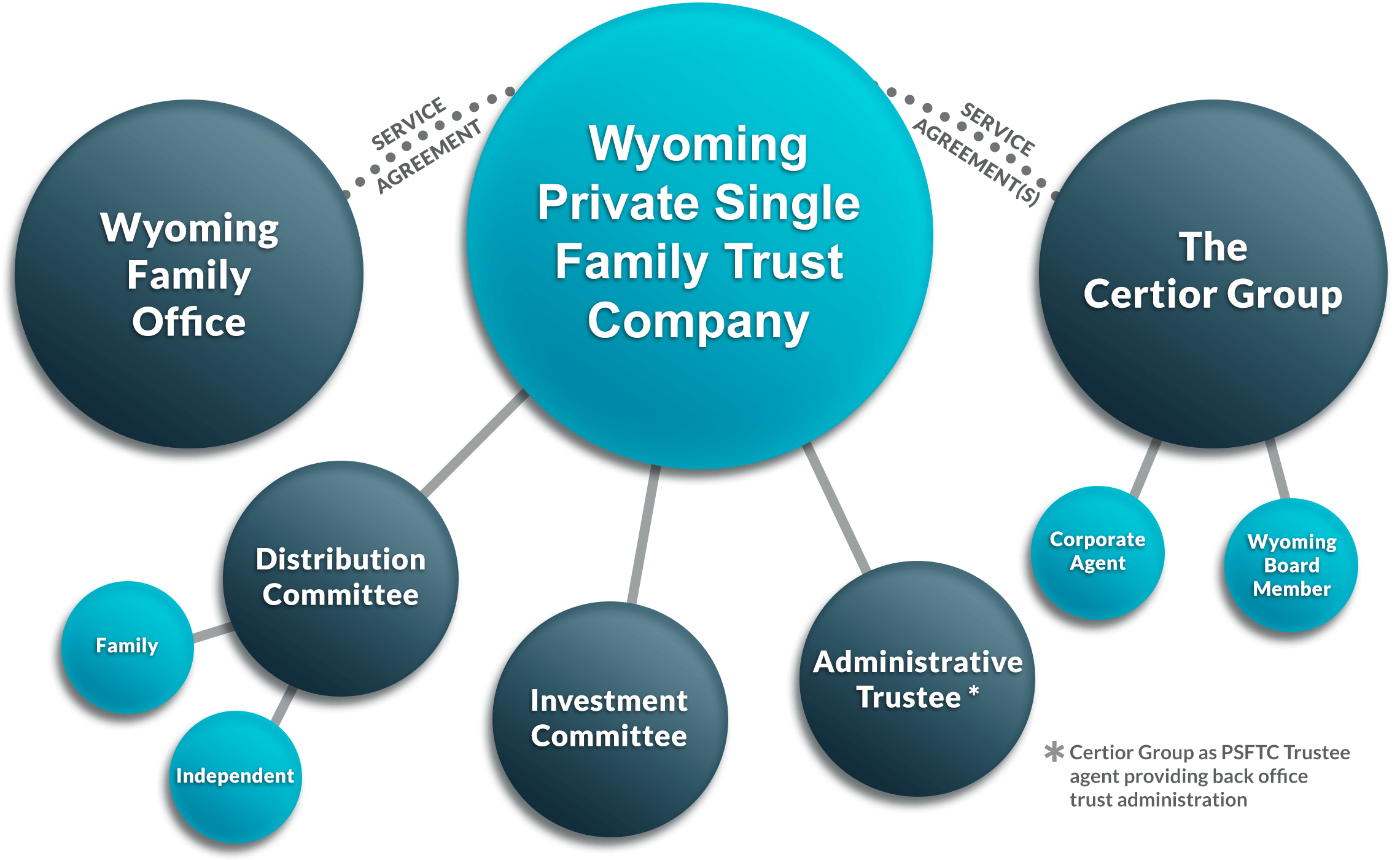

How Does the Private Single Family Trust Company Operate? The Certior Group

A family trust is an important part of estate planning and wealth management, as it allows control over how assets are distributed among family members according to one's wishes. It can take the form of a discretionary trust, where the trustee has full discretion over how much money to give each family member, or it can also be a.