What is an angel investor? Avasam

Angel Investment Market Around the World Course

On average, angel groups invested a total of $5.3 million per group, an increase of 15% from 2020. The total amount invested in 2021 represents the highest total since we began tracking this data. Angels invested more dollars per company than years prior, although the absolute number of deals per group declined slightly.

Angel Investment for Retail Investors AMA Episode 1 POD YouTube

We document that the choice between disintermediated individual angel investments and intermediated private equity and venture capital investments depends on legal, economic, and cultural differences. We find evidence of this using PitchBook's comprehensive data on more than 5000 angel and 80,000 private equity and venture capital investments in 96 countries from 1977 to 2012. The data.

Angel investor 2018 by World Business Angels Investment Forum Issuu

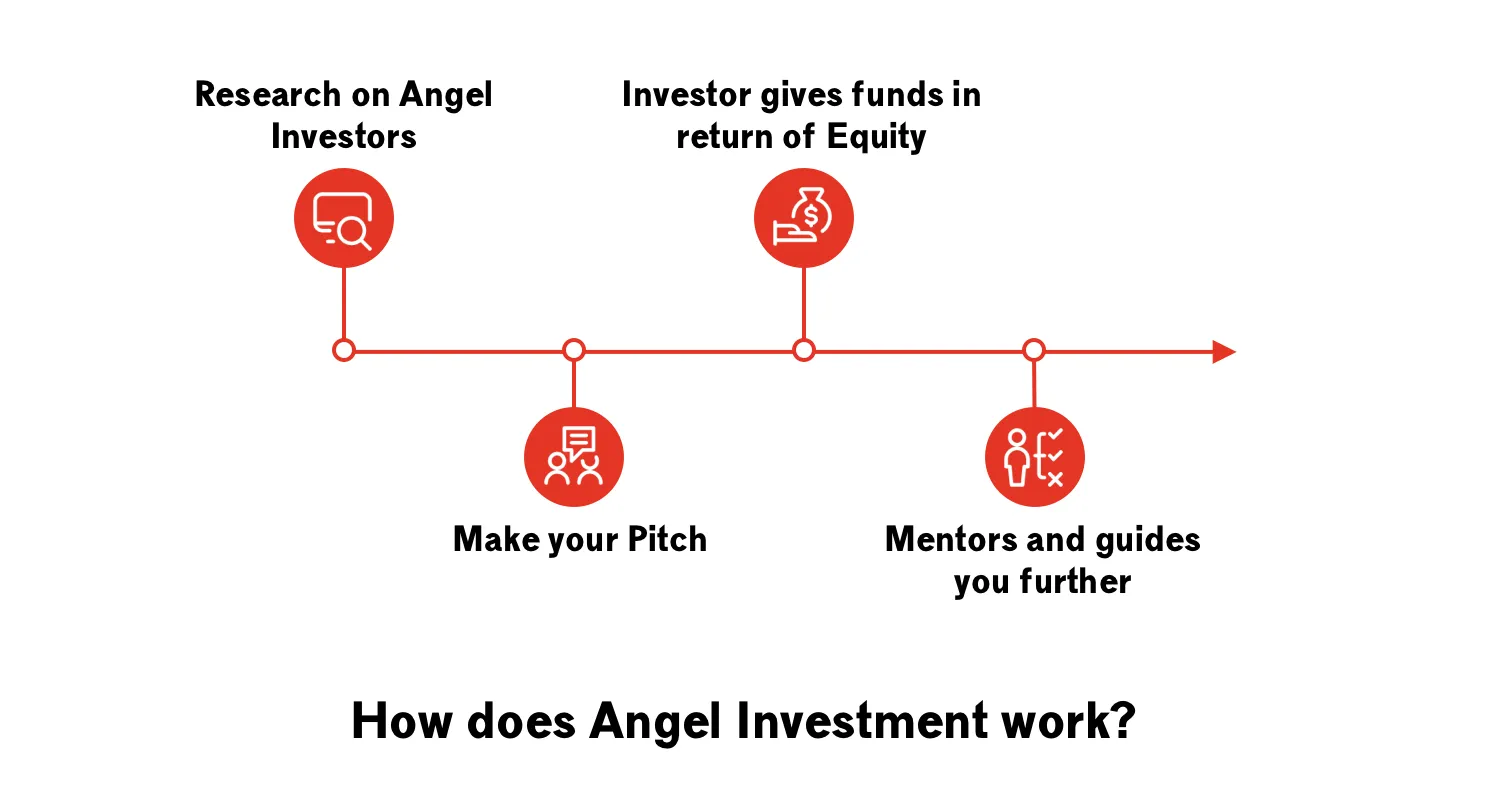

An angel investor is an individual who provides capital for a business startup, usually in exchange for convertible debt or ownership equity. Angel investors are often wealthy individuals who have made their money in another industry and are looking to invest in a high-growth startup.

Angel Investor Funding for Startups Plan Projections

Angel groups invest about $4.7 million per year across multiple companies (up 15% from last year) Angel portfolio companies leverage their angel investments to raise $4 billion total - a 6X multiple Individual angels invested in 19 companies on average, up from 14 companies last year

Angel investment in the South West Quarterly Investment Briefing techSPARK

As the term implies, an angel investor is a private investor, or someone known in business circles as an High Net Worth Individuals (HNWI). Such investors either come from wealthy families or are successful founders of well-established organizations (or conglomerates). The term was often used to refer to affluent sponsors of Broadway shows.

What is Angel Investment and Its Advantages?

The U.S. venture capital industry was born 75 years ago, launching an engine of economic growth and innovation that has created millions of jobs, driven most R&D investments, and delivered.

A detailed guide for startups on getting angel investment in India WhySkyIsBlue

The angel investor market in 2020 saw an increase in both the number of active investors and the number of investments as well as a 6% increase in the total dollars invested by angels, according to the latest angel market analysis by the Center for Venture Research at the University of New Hampshire.

What You Need to Know About Angel Investment Valuation Eqvista

Angel investors are the primary source of outside capital for promising startups and entrepreneurs - providing an estimated 90% of such outside funds. Every year angels invest about $25 billion in more than 70,000 startups.

What is an angel investor? Avasam

The Angel Funders Report analyzes angel capital investments made during 2019, and features profiles, stories, and insights from leading angel investors and startup company executives. The report also includes initial perspectives regarding the impact of the COVID-19 pandemic on the investing ecosystem.

2019 U.S. Angel Investment Statistics Infographic Orange County Startup News Blog

Written by Dave Lavinsky This guide to angel investors results from 20+ years of Growthink helping entrepreneurs and businesses raise angel funding. Over this time, we have helped pitch thousands of angel investors, hosted angel investor gatherings, and even had many angel investors as clients.

Angel Investment Statistics, Invest, Investing, Investment, Angel Investing, Angel Investment,

Share Andy Wu Photo: Russ Campbell BOSTON—" The American Angel (pdf) ," a new comprehensive national study released yesterday, provides a detailed picture of angel investors--who they are, where they live, and how they make investment decisions.

Angel Investment Strategies

AEBAN is the Spanish Association of Business. Angel Networks and other players. AEBAN's mission is to promote clubs and other related players who such as family offices, investment builders, equity crowdfunding venturing activities. 28 members and operated in 9. in early-stage private investment.

Angel Investment Network complete four deals through their network UK Business Angels Association

Angel investors around the world Douglas Cumming and Minjie Zhang 693 Journal of International Business Studies (2015) extended the results of Kerr et al. (2014)to. present the data and our summary statistics, fol-lowed by regression analyses and robustness checks. In the final sections, we discuss some

How To Start An Angel Investment Fund (2023)

1. Introduction. The tremendous growth of angel investment and venture capital (VC) investment over the past two decades (Chemmanur and Fulghieri, 2014; Gornall and Strebulaev, 2015) calls for a deeper understanding of the early stage startup investment decision process.Such investment decisions face a great deal of information asymmetry (Hochberg et al., 2018; Howell, 2020).

Angel Investment Opportunity In Quantel StartupLanes

Economic Impact of Angel Investing Can Be Measured Economic Impact of Angel Investing on Communities, Investors and Founders Investing Trends Impact of Stock Market Drops on Exits, Shutdowns and Investment Levels 2022 Angel Investment Sentiment Versus 2021 The Equity Seller's Bubble of 2021 Returns Ethnically Diverse Founders Produce Better Returns

Does Angel Investment Network Work? A Comprehensive Overview The Enlightened Mindset

The median investment is around EUR 30,000 in the latest research. However, investment volumes are irregularly distributed. Only about one-tenth of investments were above EUR 200,000, and the top 2 percent of investments are in the range of EUR 1 million and sometimes even above.