Get the VAT number for your business in any EU country

What is a VAT?

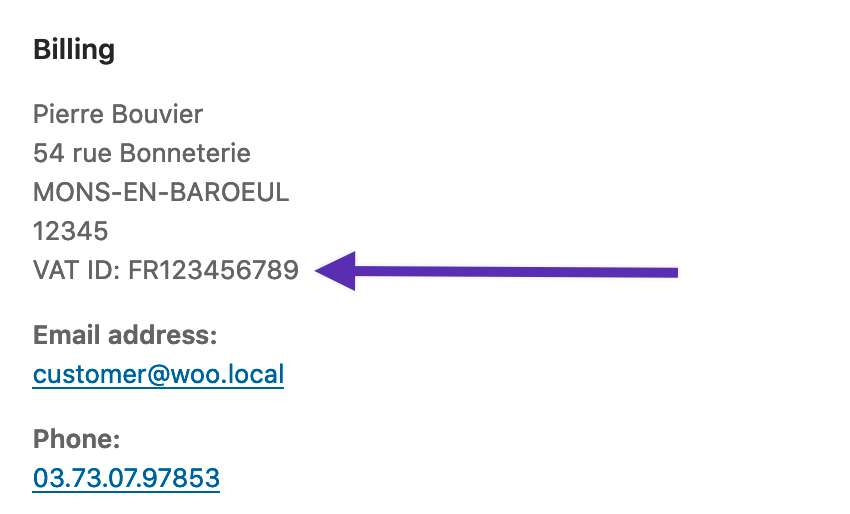

The importance of VAT numbers. Used to identify tax status of the customer. Help to identify the place of taxation. Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that.

How to get a VAT number in the EU

The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It applies more or less to all goods and services that are bought and sold for use or consumption in the European Union. Thus, goods which are sold for export or services which are sold to customers.

How VAT works and is collected (valueadded tax) Novashare

Se state acquistando o importando prodotti da aziende estere è bene sapere il vat number cos è e di cosa si tratta per evitare di commettere errori durante la transazione. Questo è uno strumento che già conoscete quindi non preoccupatevi se durante un acquisto o una transazione online da un sito estero ricevete messaggi di errori o di avviso in cui vi sarà chiesto di inserire se possibile.

VAT in UAE Value Added Tax in Dubai VAT SAB Auditing

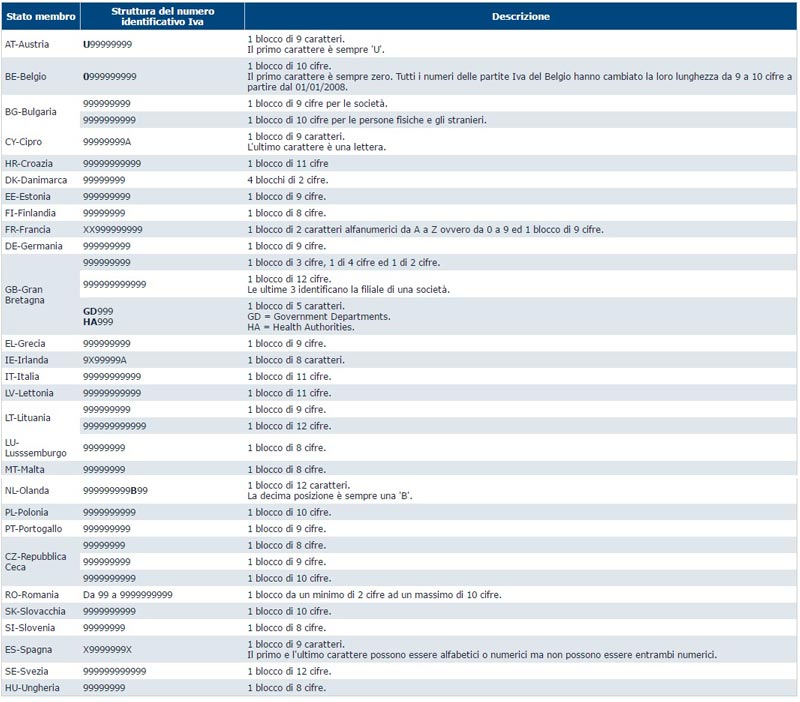

VIES VAT number validation. Close . Important Disclaimer: As of 01/01/2021, the VoW service to validate UK (GB) VAT numbers ceased to exist while a new service to validate VAT numbers of businesses operating under the Protocol on Ireland and Northern Ireland appeared. These VAT numbers are starting with the "XI" prefix, which may be found.

VAT Number cos’è, cosa significa, cosa c’entra con la partita IVA

Code used on purchase form. 20.0%ECG. Intra EU B2B purchase of goods. In business to business transactions, the customer must pay for any VAT due via the reverse charge mechanism. The customer has to act as though they are both the supplier and recipient of goods. N/A. +/- VAT at 20% to Box 2 and 4+/- Net.

Get the VAT number for your business in any EU country

Cos'è VIES? VIES (sistema per lo scambio di informazioni sull'IVA) è un motore di ricerca (non una banca dati) di cui la Commissione europea è titolare. Quando si avvia una ricerca, le informazioni vengono recuperate dalle banche dati nazionali sull'IVA. Il risultato della ricerca può essere di due tipi: informazioni esistenti ( valido) o.

What is the VAT Number? iContainers

La Partita IVA, o VAT Number, è un codice fiscale utilizzato in Italia per identificare le imprese e gli individui che svolgono attività commerciali. Questo codice è necessario per poter emettere fatture, dedurre le spese aziendali e pagare le tasse. Per ottenere una Partita IVA, è necessario registrarsi presso l'Agenzia delle Entrate e.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

The VAT ID is composed like this: country code NL, 9 digits, the letter 'B' and 2 check digits. The 9 digits are not related to your citizen service number and the 2 check digits are random. The VAT ID will then look like this for example: NL000099998B57. The VAT tax number (turnover tax number) consists of either the Legal Entities and.

Cos'è il VAT NUMBER e come ottenerlo?

In Italy the standard Vat rate is 22% and reduced rates are provided for several supplies of goods and services, such as 4% for listed food, drinks and agricultural products or 10% for electric power supplies for listed uses and listed drugs. Specific supplies of goods and services expressly listed in Presidential Decree n. 633/72 are exempt.

EU VAT Number

The first 9 digits are the SIREN number and the following 5 digits are the NIC number ( Numéro Interne de Classement ). The SIRET number provides information about the location of the business in France (for established companies). More info (in French) can be found in this website of the French authorities. The EU VAT number must be used for.

Cos'è e come verificare velocemente il VAT number? Gestionale.co

Intra-Community VAT Number. Verified 14 March 2023 - Directorate for Legal and Administrative Information (Prime Minister) Every company subject to VAT within the European Union (EU) has an individual tax identification number. It is issued by the tax department of the country in which she is domiciled. The company must include this number on.

Vat number Spain ¿Que es? obtener uno? » AJC Asesor Fiscal

So obtaining the Italian company registration number is one of the first steps when starting a company. Beginning with this information, a Company Registration Report (sometimes called a Company Profile) will be generated. This is an informational document containing all the details regarding the registered business, including legal information.

VIES Reporting and how to check VAT numbers STAR Translation

Nello specifico, col VAT Number parliamo di strumento elettronico utile a verificare il numero della partita IVA, di tutte le imprese registrate all'interno della comunità europea. Lo scopo del codice e' di controllare che il numero di Partita IVA di imprese e professionisti di tutta la UE sia effettivamente valido.

VAT identification number cos’è come funziona, quando, a cosa serve

The tax identification number provides a means of identification of foreign citizens in their relations with public authorities and other administrations. For individuals, it is determined on the basis of personal data and is made up of an expression of 16 alphanumeric characters.. Tax code / Vat number: 06363391001. Follow us on Facebook.

New Company with VAT Number UK First VAT All VAT services at one place

VOEC (VAT On E-Commerce) Number Format: "VOECxxxxxxx" Positions 1-4 are "VOEC" Positions 5-11 are numeric digits. When processing a shipment and depending on the details, WorldShip may display the VCID interview questions to determine if the shipment requires a VCID. The interview will either return to the Shipping Tab for a VCID or continue.

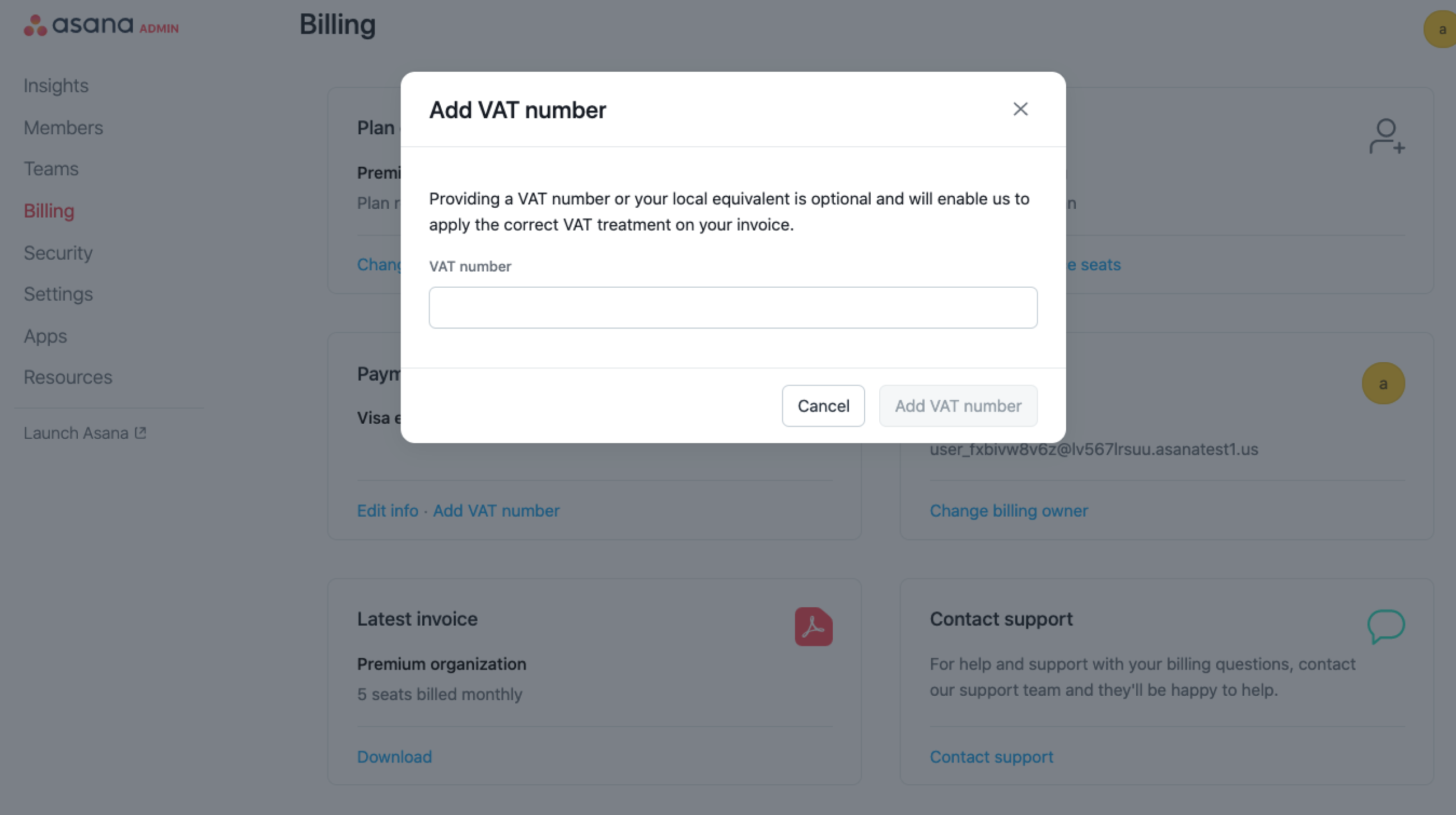

VAT • Asana Product Guide

Che cos'è il VAT number e come si utilizza per le operazioni intracomunitarie. L'acronimo VAT deriva dall'espressione inglese Value Added Tax. Chi ha dimestichezza con la lingua inglese avrà già capito che essa sta per Imposta sul Valore Aggiunto. Pertanto, la VAT altro non è che la nostra IVA. Che cos'è il VAT identification number