AIDEMÉMOIRE DÉBIT VS CRÉDIT Création et programmation de formulaires Sage 50 Simple

Comment lire et interpréter les comptes en compta ? Initiation Débit Crédit Comptabilité (2/2

A debit entry increases the balance on the asset side, while a credit entry reduces the balance. For example, if the company purchases equipment worth $10,000 using a check, it will increase the asset balance by $10,000. Similarly, if the company sells an item in its stock (asset) at $100, it will decrease the asset balance by $100 since it is.

NE CONFONDEZ PLUS DEBIT ET CREDIT

Le débit et le crédit sont ainsi les deux miroirs incassables d'un système matérialisant les échanges économiques. Maîtriser leur reflet est incontournable pour être en mesure de pratiquer la comptabilité et de la comprendre. A défaut, les miroirs risquent fort bien d'être déformants… A découvrir le catalogue de formations e-learning

DEBIT & CREDIT A LA BANQUE EXPLICATIONS compta banque finance comptapourlesnuls

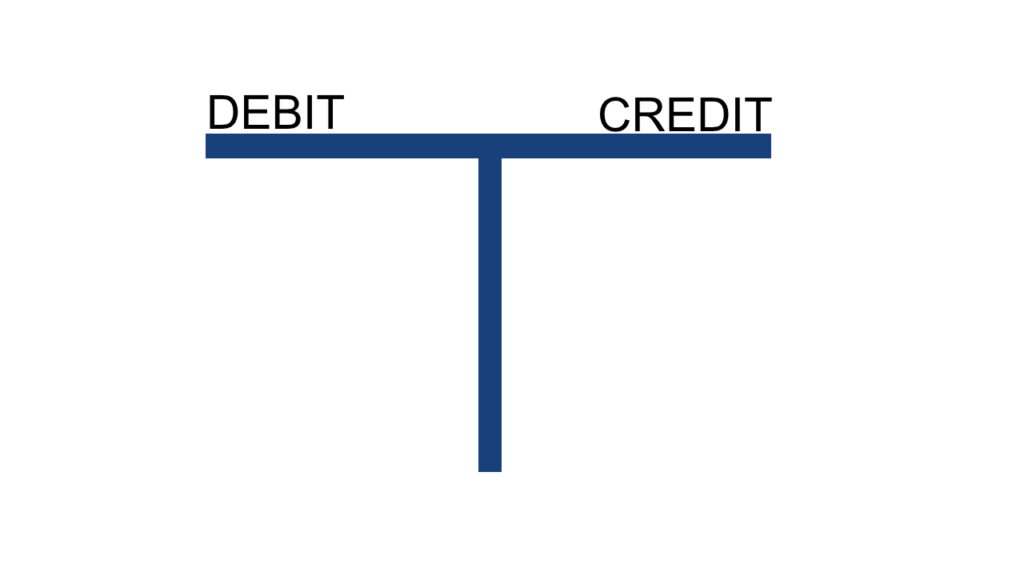

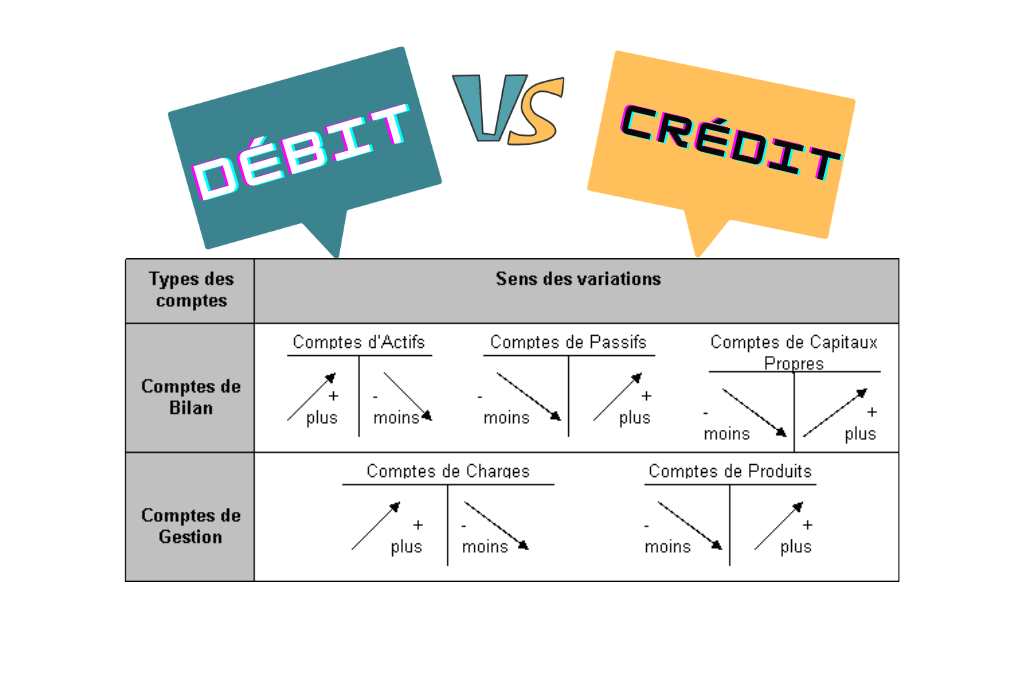

Voici le principe à retenir : Le débit est tout simplement la colonne de gauche d'un compte et le crédit la colonne de droite. Ni plus, ni moins 🙂 . Oui, mais comment sait-on qu'il faut mettre une somme au débit plutôt qu'au crédit ? Chaque opération qui se produit dans une entreprise s'enregistre dans les comptes de sa comptabilité.

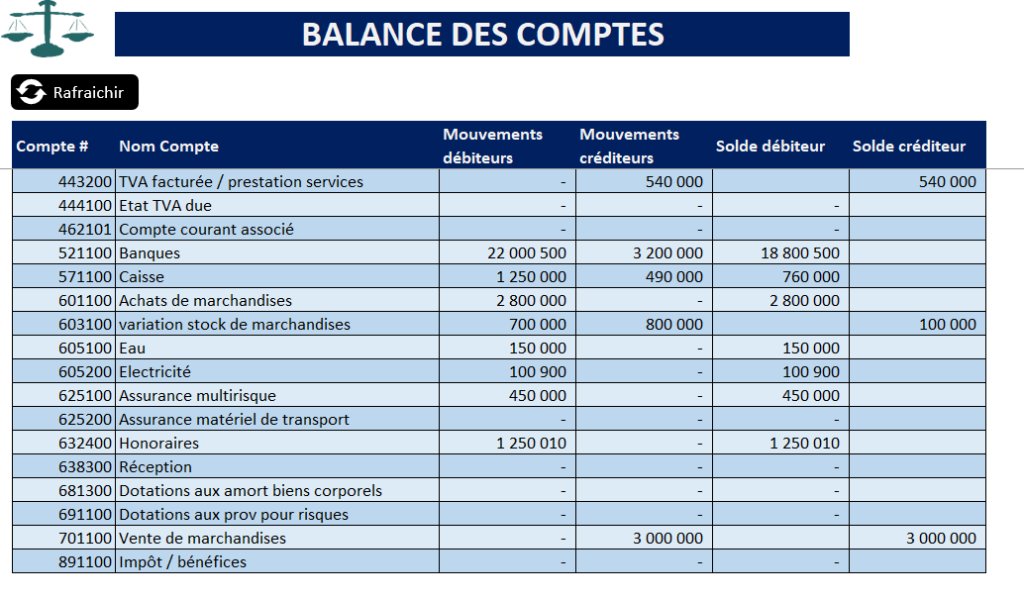

M.A AUDITS & ACADEMI Debit vs Credit in Accounting

As a result, your business posts a $50,000 debit to its cash account, which is an asset account. It also places a $50,000 credit to its bonds payable account, which is a liability account. Plug these numbers into the formula and you get: $50,000 = $50,000 + $0.

Principe DÉBIT et CRÉDIT aussi Compte colonne SÉPARE avec AHMED FETTAH Compta DARIJA YouTube

Debit: A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company's balance sheet . In fundamental accounting, debits are balanced by.

Café compta Cours de la comptabilité (S1) La partie Double Débit / Crédit Partie 5 YouTube

First: Debit what comes in and credit what goes out. Second: Debit all expenses and credit all incomes and gains. Third: Debit the Receiver, Credit the giver. To compress, the debit is 'Dr' and the credit is 'Cr'. So, a ledger account, also known as a T-account, consists of two sides.

Débit et crédit en comptabilité tout comprendre en 3 min

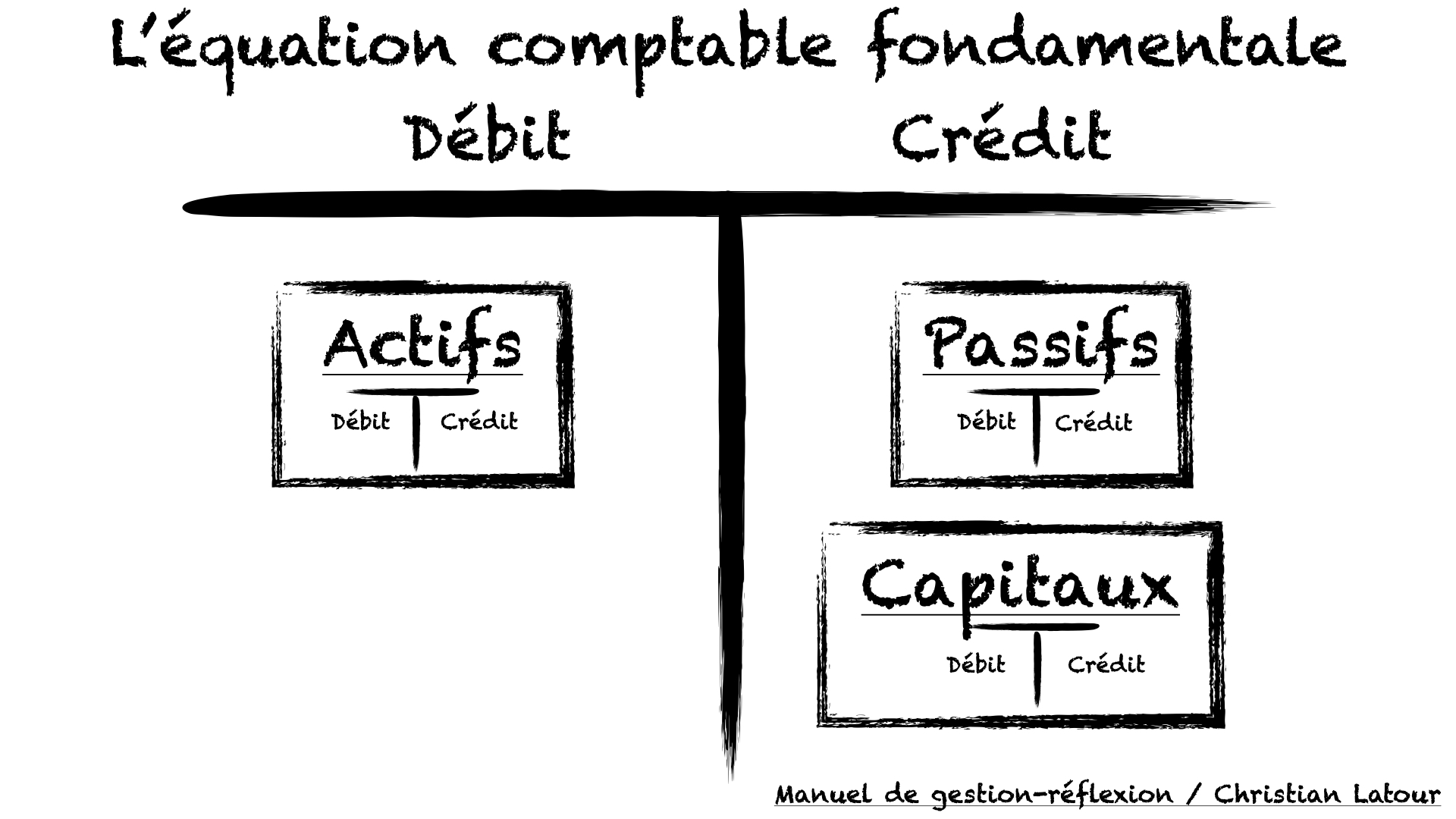

Equity accounts. A debit decreases the balance and a credit increases the balance. The reason for this seeming reversal of the use of debits and credits is caused by the underlying accounting equation upon which the entire structure of accounting transactions are built, which is: Assets = Liabilities + Equity.

What are the Rules of Debit and Credit? Debit vs Credit

Le débit et le crédit sont étroitement liés à la comptabilité dite en partie double . Ce mécanisme peut être décrit comme le miroir d'une opération, chaque écriture comptable étant ventilée en deux colonnes. La partie double permet donc de refléter précisément les flux financiers d'une entreprise, qu'elle les émettent ou qu'elle les reçoivent.

LE MODELE COMPTABLE LES COMPTES

Débit et crédit en comptabilité : tout comprendre en 3 min Le débit et le crédit en comptabilité sont des notions complémentaires dans les écritures comptables de l'entreprise. Découvrez ce qu'il faut savoir à ce sujet.

NE CONFONDEZ PLUS DEBIT ET CREDIT

Our new EMV debit cards take your account security to the next level. Shop online and in person knowing your account is secure. Customizable to your preferences. Fast and easy to use. Loan Officers Are Standing By To Help You. Applying for a loan is now easier than ever. Agricultural;

Débit et crédit comprendre leur signification et leur utilité dans la comptabilité d’une

Debits are recorded on the left side of an accounting journal entry. A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry. Increase asset, expense and loss accounts.

NeoBanking EQapital Trust

This system is based on the concept of debits and credits. In this context, debits and credits represent two sides of a transaction. Depending on the type of account impacted by the entry, a debit can increase or decrease the value of the account. The same is true for a credit. If a transaction increases the value of one account, it must.

COMMENT TENIR SA COMPTABILITE SUR EXCEL

Key concepts Selected accounts Accounting standards Financial statements Bookkeeping Auditing People and organizations Development Misconduct v t e Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions.

Différence entre débit et crédit en comptabilité • Economie et Gestion

Debit #1000 Cash $15,000 (increase) Credit #9000 Revenue- sales $15,000 (increase) (To record sales to customers paid for in cash) Both cash and revenue are increased, and revenue is increased with a credit. As you process more accounting transactions, you'll become more familiar with this process.

La règle du débit et du crédit HRImag HOTELS, RESTAURANTS et INSTITUTIONS

Debits and credits help maintain balance in financial transactions through the double-entry bookkeeping system. Every transaction involves a debit and a credit, ensuring that the total debits equal the total credits. Recording the impact of each transaction on different accounts, such as assets, liabilities, equity, revenues, debits, and.

AIDEMÉMOIRE DÉBIT VS CRÉDIT Création et programmation de formulaires Sage 50 Simple

You debit your furniture account, because value is flowing into it (a desk). In double-entry accounting, every debit (inflow) always has a corresponding credit (outflow). So we record them together in one entry. An accountant would say that we are crediting the bank account $600 and debiting the furniture account $600.