What is Velocity Banking and How Does It Work?

Velocity Banking Spreadsheet Template —

If you owe $250,000 and your house is worth $320,000, you can qualify for a $59,000 HELOC at a low 3 or 4% interest rate. HELOC's typically have a draw period of 5 to 10 years and they behave like a regular checking account. You can easily move money in and out to pay your bills using your HELOC, or pay off your HELOC using your paycheck.

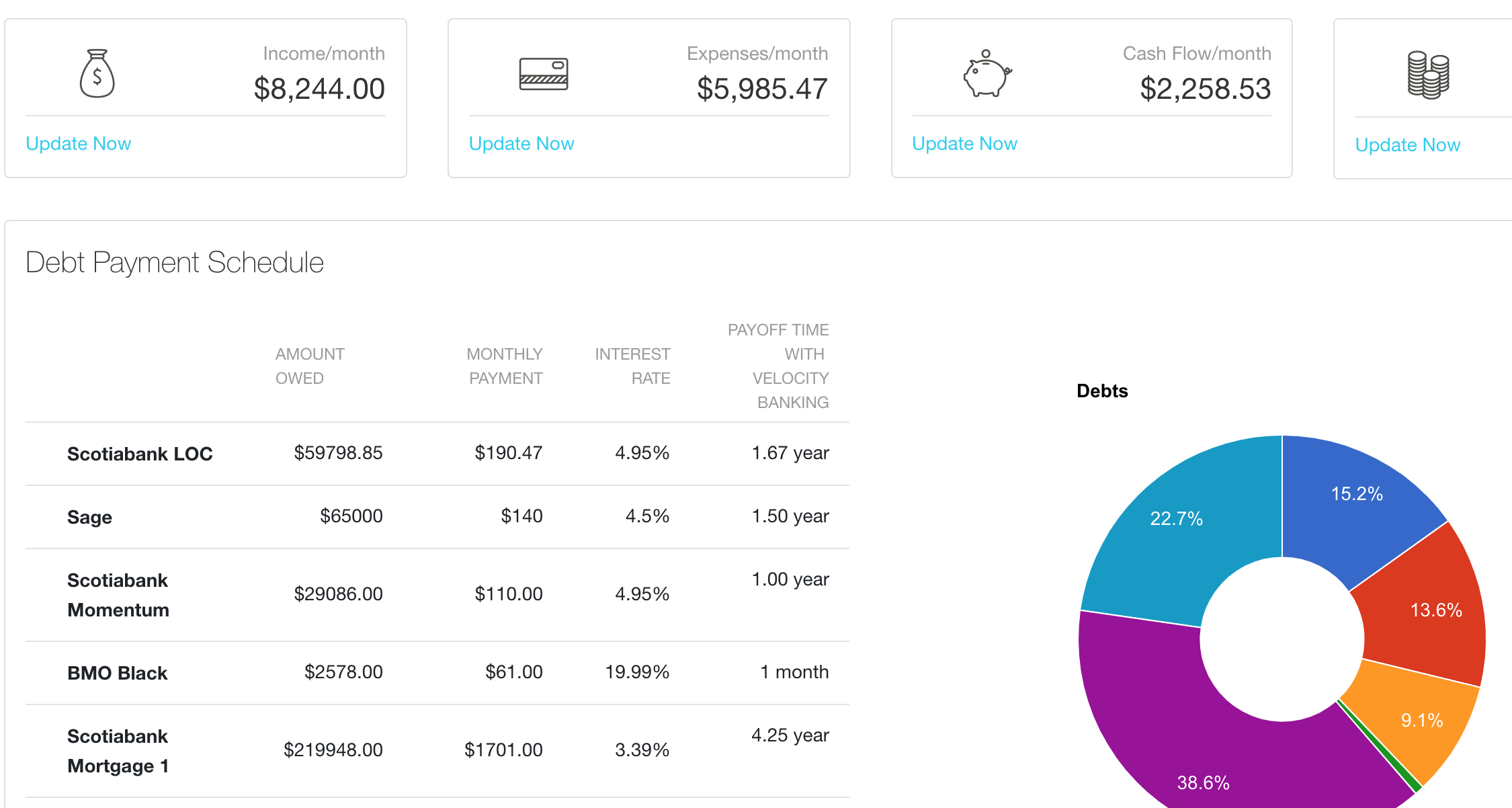

VelocityBanking Free Online Debt Management

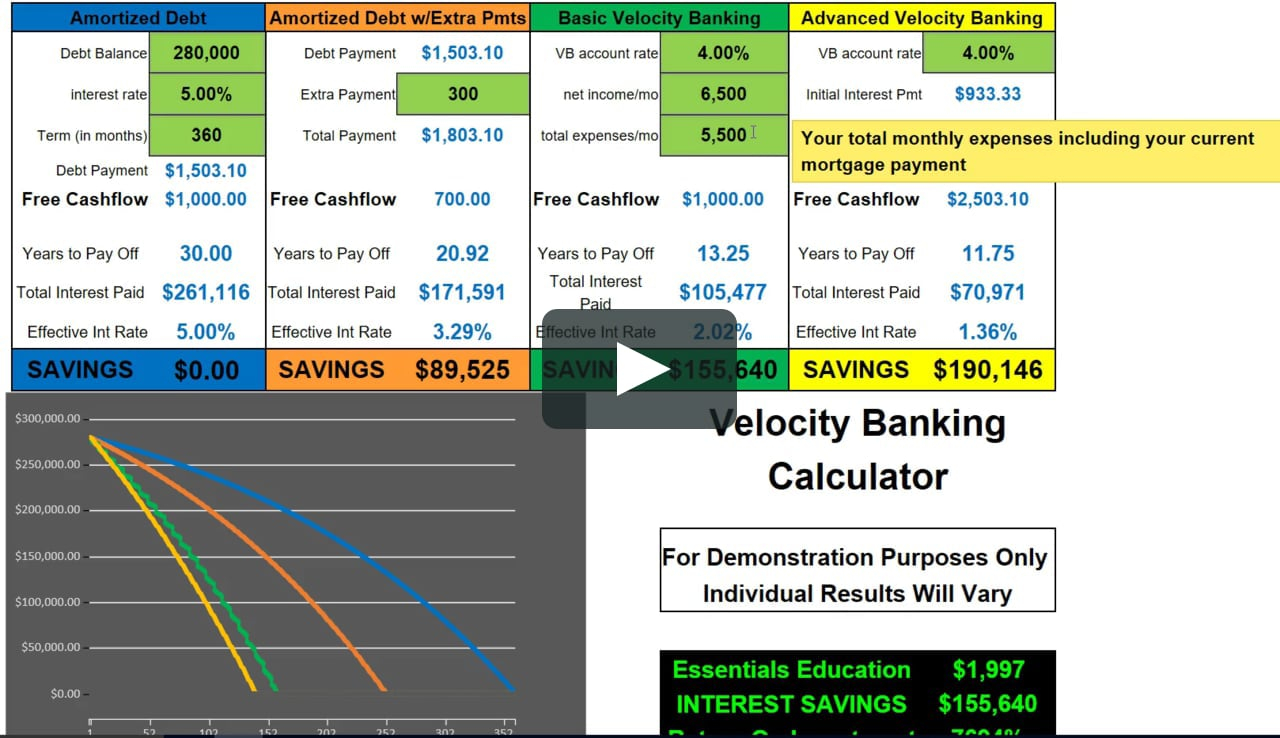

Discover the power of accelerated payments with the Velocity Banking Calculator. Use the chunking calculator to determine the years of payments you'll save.

Velocity Banking Spreadsheet 1 Google Spreadshee velocity banking

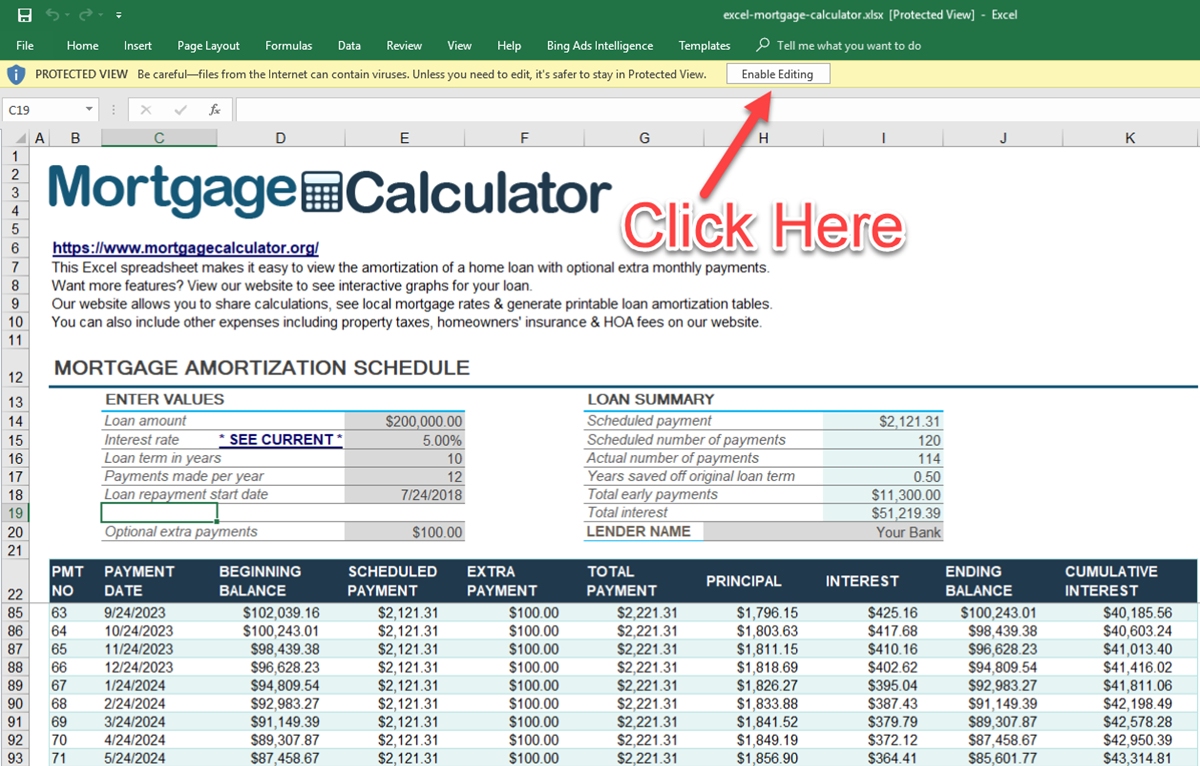

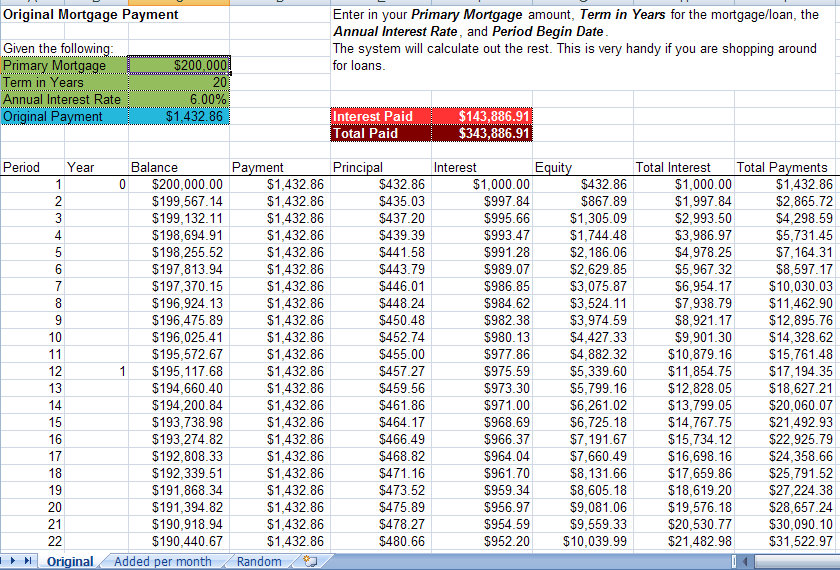

Velocity banking is a personal finance hack that can help you pay off your mortgage fast. We explain what it is and whether it's a good idea.. I used a calculator from the website Truth In Equity, entering these details: $200,000 mortgage balance. Appraised home value of $250,000.

VelocityBanking Free Online Debt Management

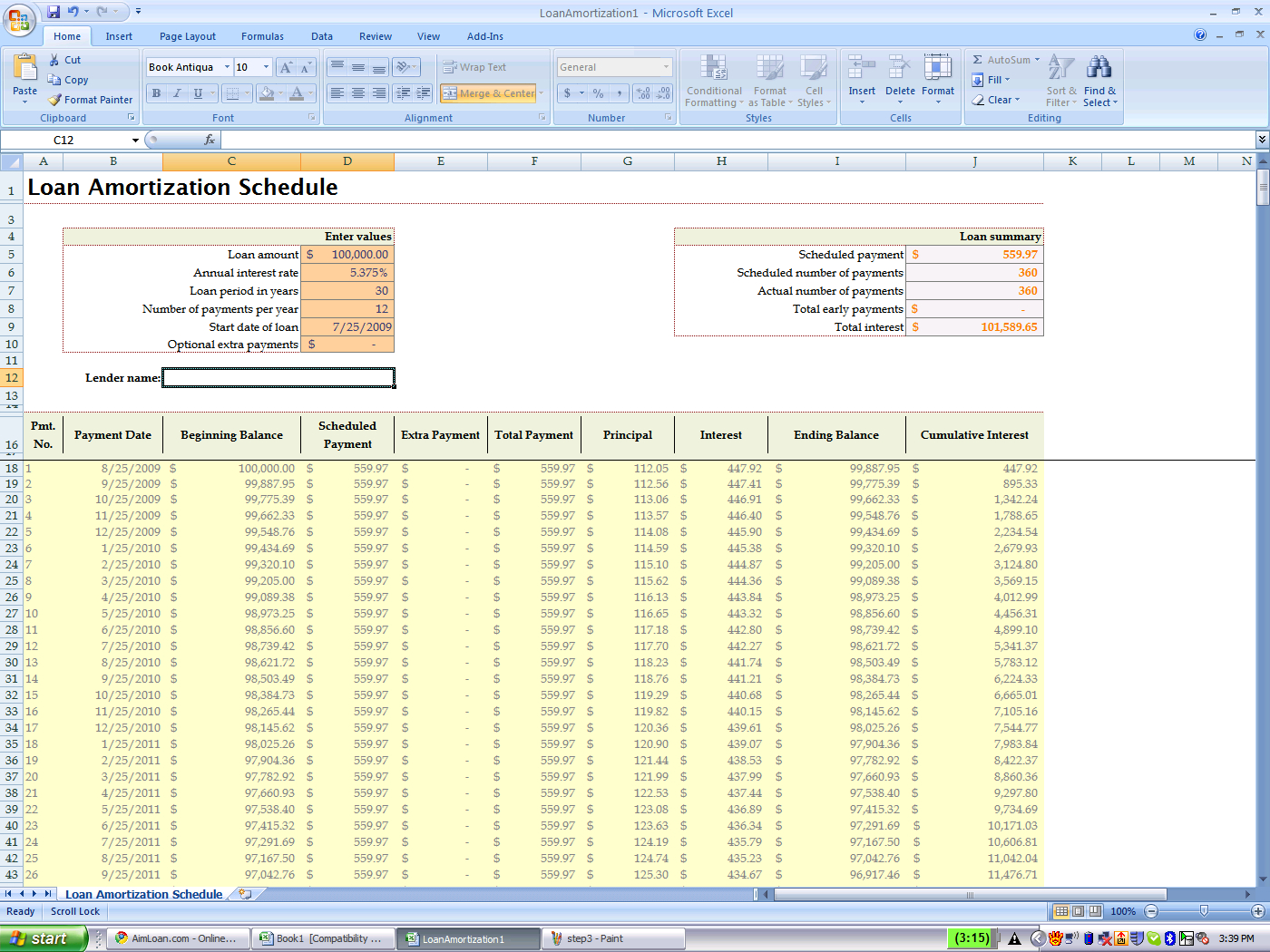

53K subscribers Subscribe 15K views 4 years ago Velocity Banking Training Series In this video, I'll show you how to use Mike's basic loan amortization & payoff calculator. You can download.

Velocity banking Definition, Pros and Cons, Advantages Ascendant

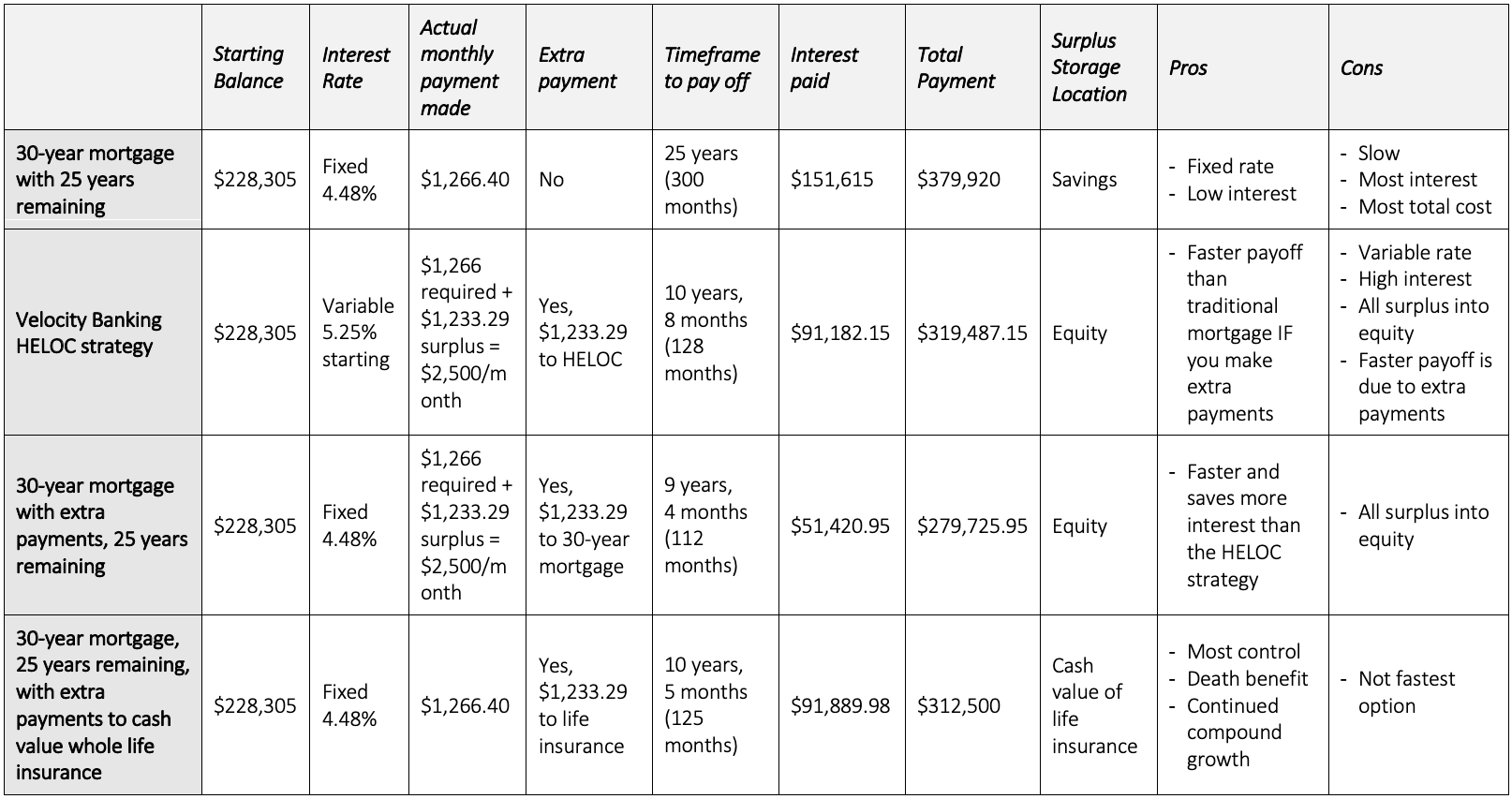

So what is velocity banking? Is the velocity banking strategy a good idea for your clients? And where's the numerical proof? Fortunately, the Truth Concepts calculators are primed to tell this story and give you the whole truth about velocity banking as any velocity banking calculator really should-no gimmicks, just numbers.

Pay Off Your House Is Velocity Banking the Fastest Way?

The Velocity Banking Calculator support you find out how long it will take to save a particular amount of money with accelerated payments. Accelerated payments allow you to pay more on your mortgage early in exchange for lower monthly payments. When calculating acceleration, use our chunking calculator to determine the years saved.

HELOC Calculator Walkthrough (Velocity Banking/Accelerated Banking

Table of Contents What is velocity banking? Velocity banking is a debt payoff method used to accelerate paying down a mortgage or other debts. This strategy typically utilizes a Home Equity Line of Credit (HELOC) to maximize net income and pay down your mortgage debt while minimizing interest costs.

Velocity Banking & Calculating Expenses YouTube

You can use a velocity banking calculator to help you pay down your debts more quickly. First, you need to input the balance of each account and the amount of money coming in (either monthly or annually), and then this tool will calculate how long it would take for your debts to become zero. Thanks for visiting.

Velocity Banking Explained How It Works + Should You Do It

How velocity banking is supposed to work (and what could really happen) Step 1: Take out a mortgage. If you have a $300,000 mortgage with a 30-year payment term and a fixed 3% interest rate, you've agreed to pay your lender $1,265 each month for 360 months. That's adds up to a total of $155,000 in interest if you see the loan through.

What is Velocity Banking and How Does It Work?

In this video, I will be covering my new velocity banking calculator. This is an online loan amortization calculator that you can use with the velocity banki.

Velocity Banking

Using a velocity banking calculator, this means your first mortgage payment is around $790 in interest and $162 in principle balance repayment. Common Assumptions of Velocity Banking. The velocity banking method sounds like a simple way to pay off your mortgage quickly. Many people think that velocity banking will help them pay off their.

A guide to velocity banking calculator

It's Easy! Korean Atlanta Mentorship 1.51K subscribers Join Subscribe Subscribed 561 Share Save 19K views 3 months ago Velocity Banking Learn how to create your own Velocity Banking.

Velocity Banking Spreadsheet Template —

What is Velocity Banking? Velocity banking is a strategy that uses a Home Equity Line of Credit (HELOC) to pay off debts instead of the traditional way of paying from monthly income. Experts claim that velocity banking helps you reduce or pay off your debts faster and minimize the interest you pay. Velocity Banking vs. Infinite Banking

Velocity Banking Explained How It Works + Should You Do It

Velocity banking, also known as the HELOC strategy or mortgage acceleration strategy, is a financial technique that aims to help homeowners pay off their mortgage faster. It has gained popularity among individuals who want to become mortgage-free sooner and save thousands of dollars in interest payments.

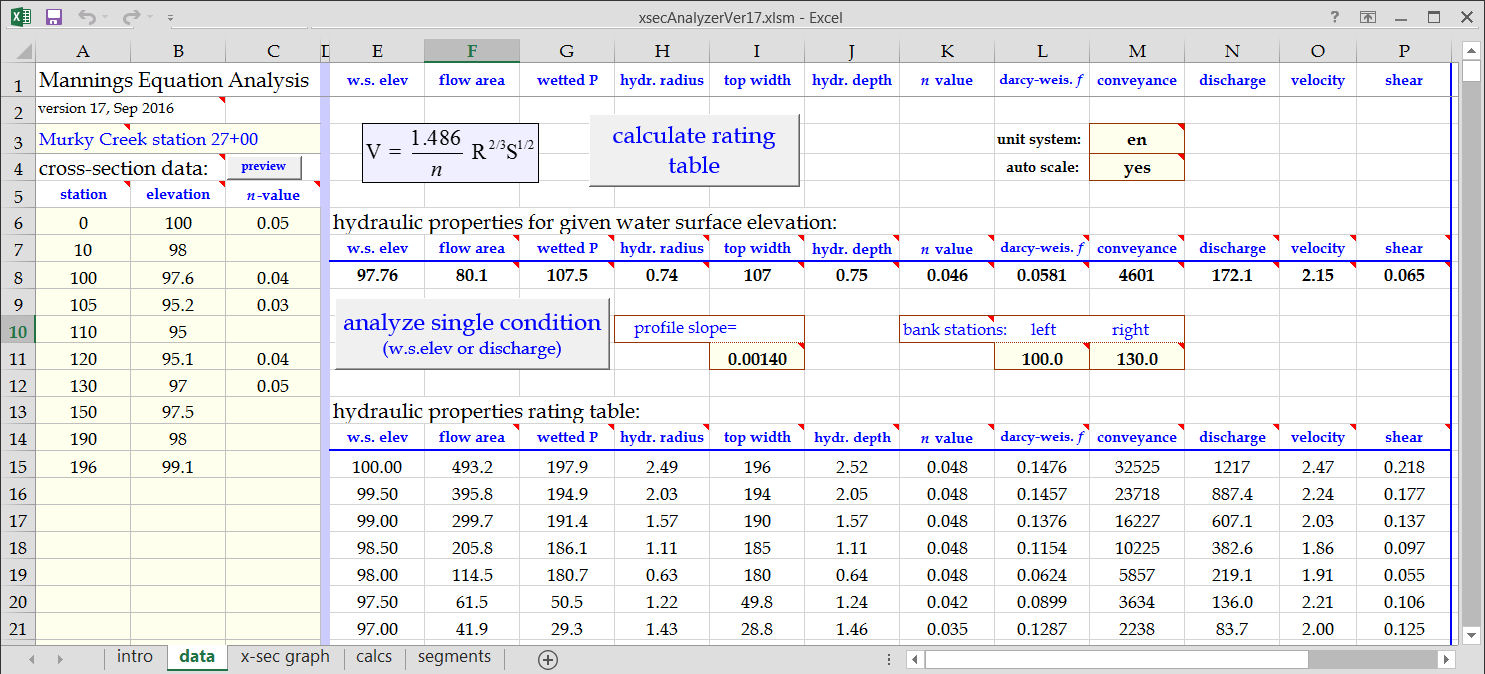

Excel Spreadsheet For Velocity Banking Taylor Hicks

This calculator helps you compare a velocity banking strategy rooted in whole life insurance, to the performance of other assets. This can help clients see how using whole life insurance for velocity banking can help them with their long-term financial strategy.

Velocity Banking Spreadsheet Template —

A velocity banking calculator is a type of useful tool/calculator that can provide you with a virtual board of your financial situation and helps make the right investment decisions. Read more to explore five types of velocity banking calculators. 5 Types of Velocity Banking Calculators Maximum Potential Calculator