Triangle Chart Patterns Complete Guide for Day Traders

Symmetrical Triangle Breakouts and Example Trading Techniques in Forex

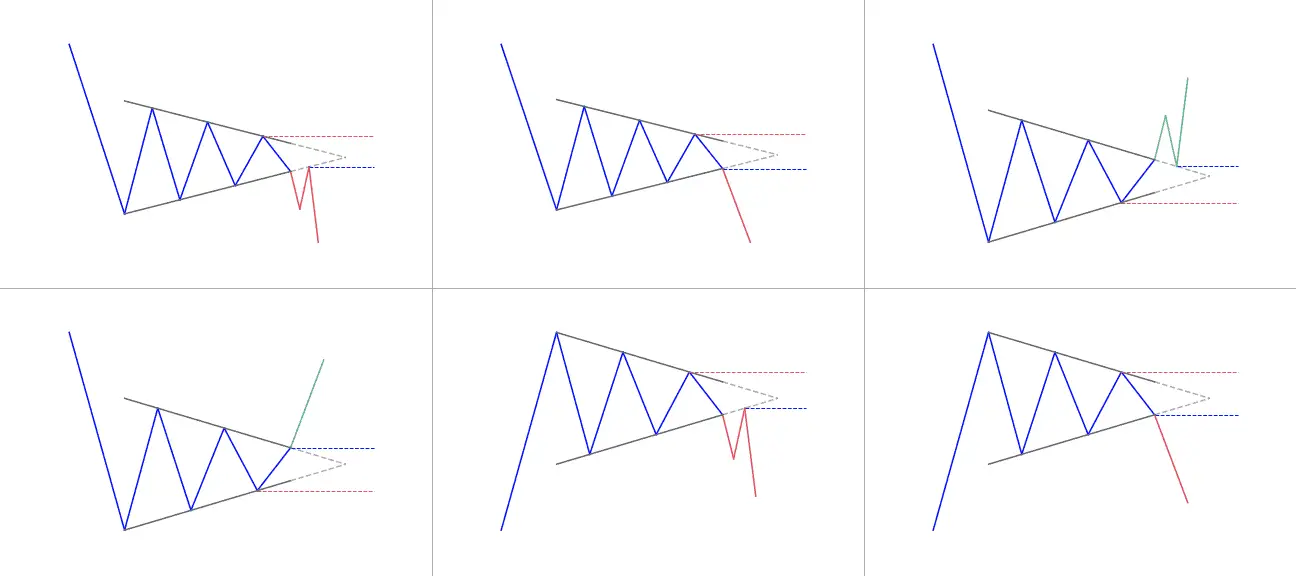

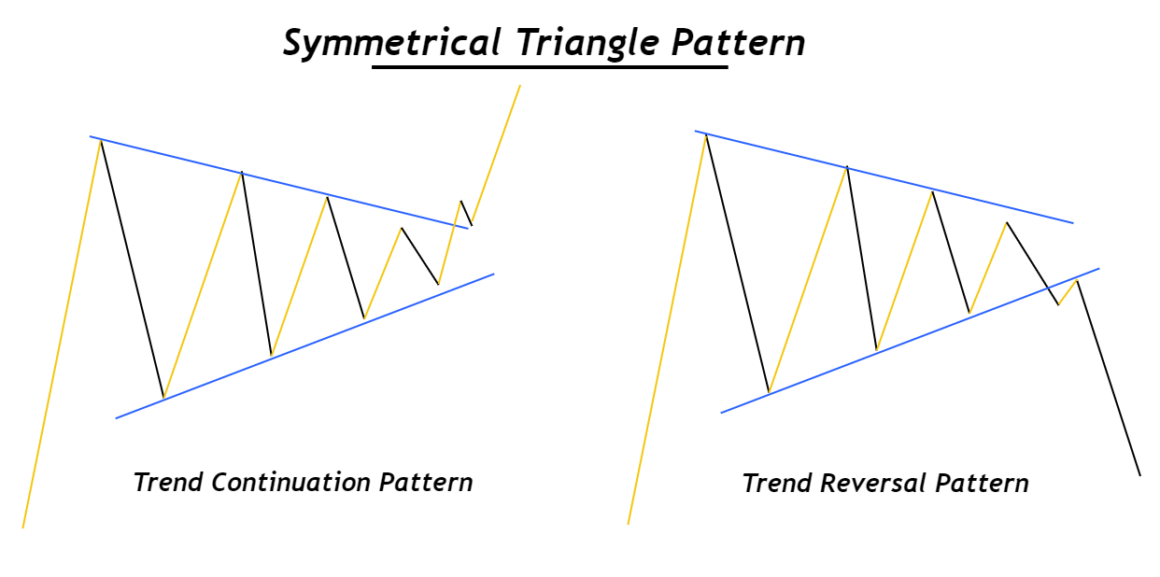

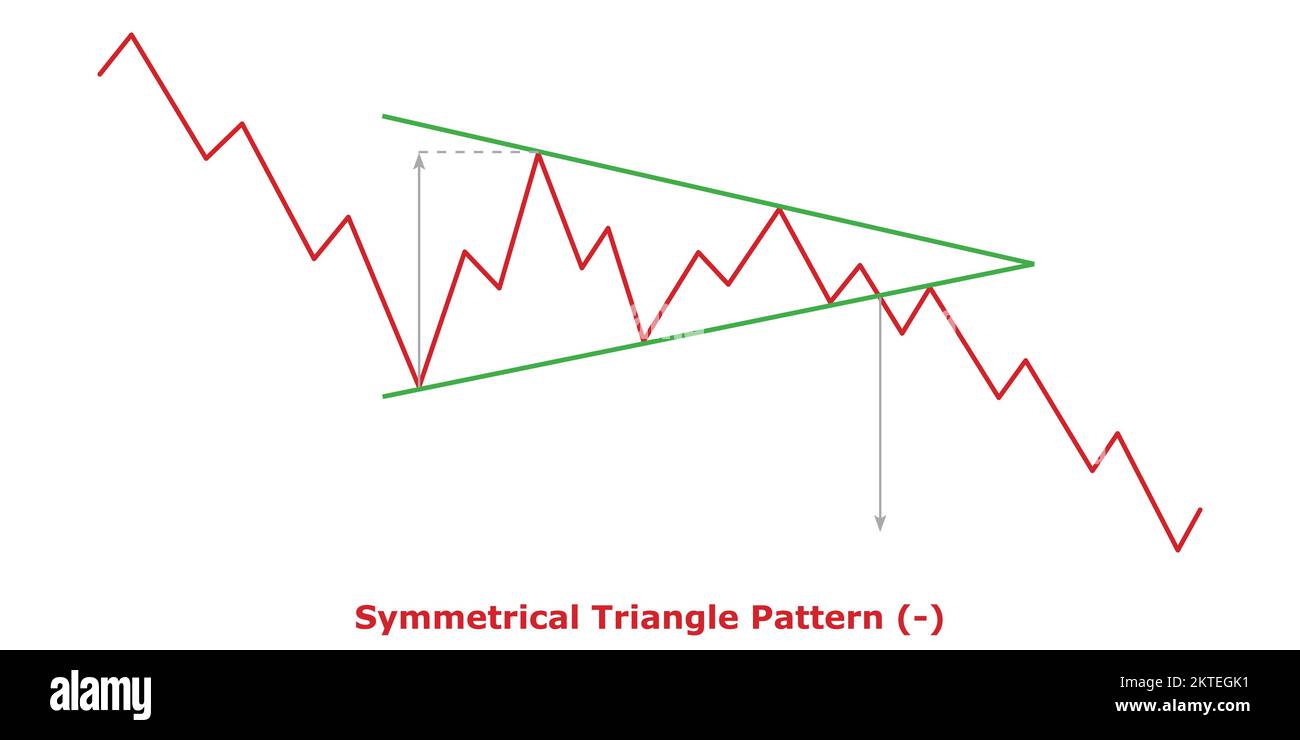

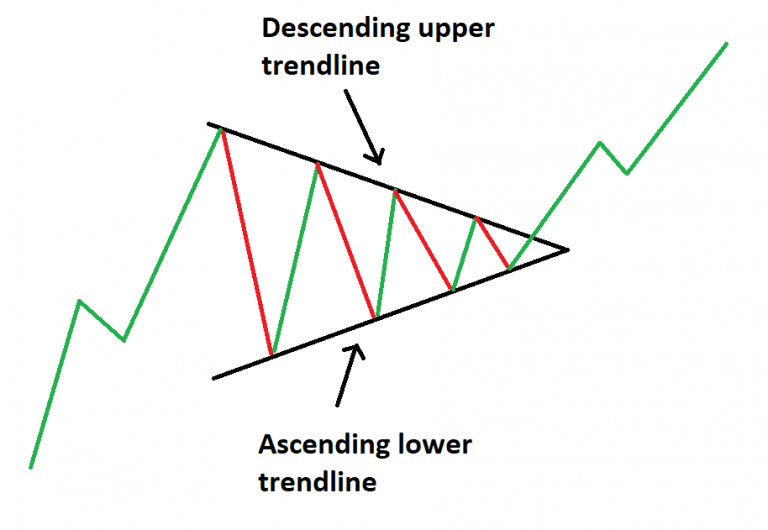

The symmetrical triangle pattern is formed by two converging trendlines. The upper trendline connects a series of lower highs, while the lower trendline connects a series of higher lows. As the pattern progresses, the range between the trendlines narrows, indicating decreasing price volatility.

How to trade a Symmetrical Triangle pattern? PatternsWizard

A symmetrical triangle pattern consists of many candlesticks forming a big sideways triangle. It is a neutral candlestick pattern. Symmetrical triangle patterns form by connecting at least two to three lower highs and higher lows, which become trend lines. Those trend lines converge and form an apex point, forming trends as continuation patterns.

Symmetrical Triangle Definition How To Trade And Use This Pattern On

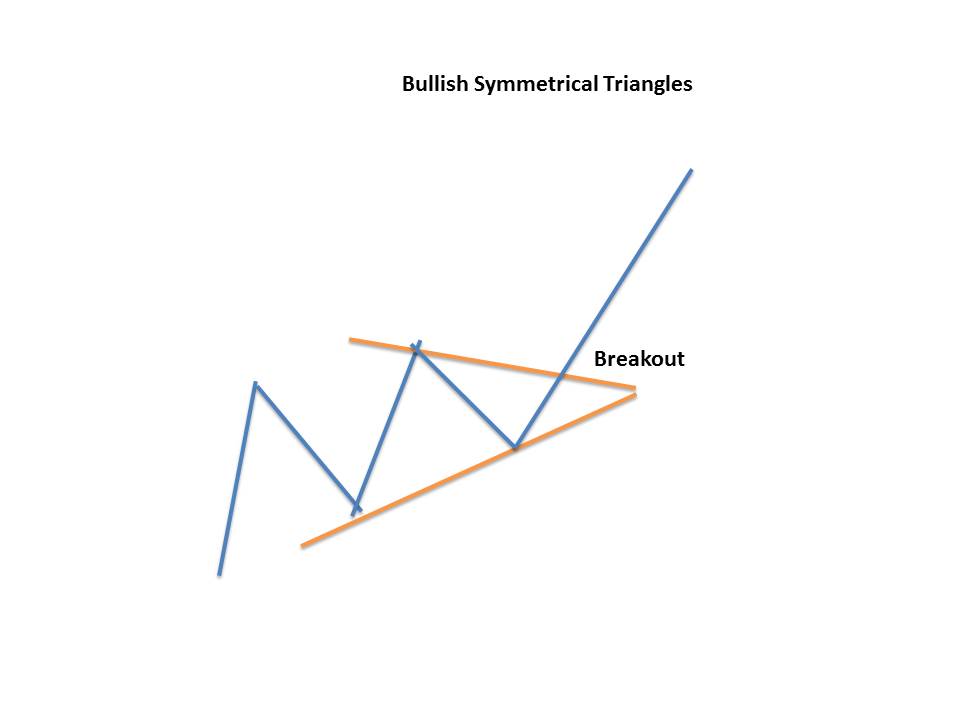

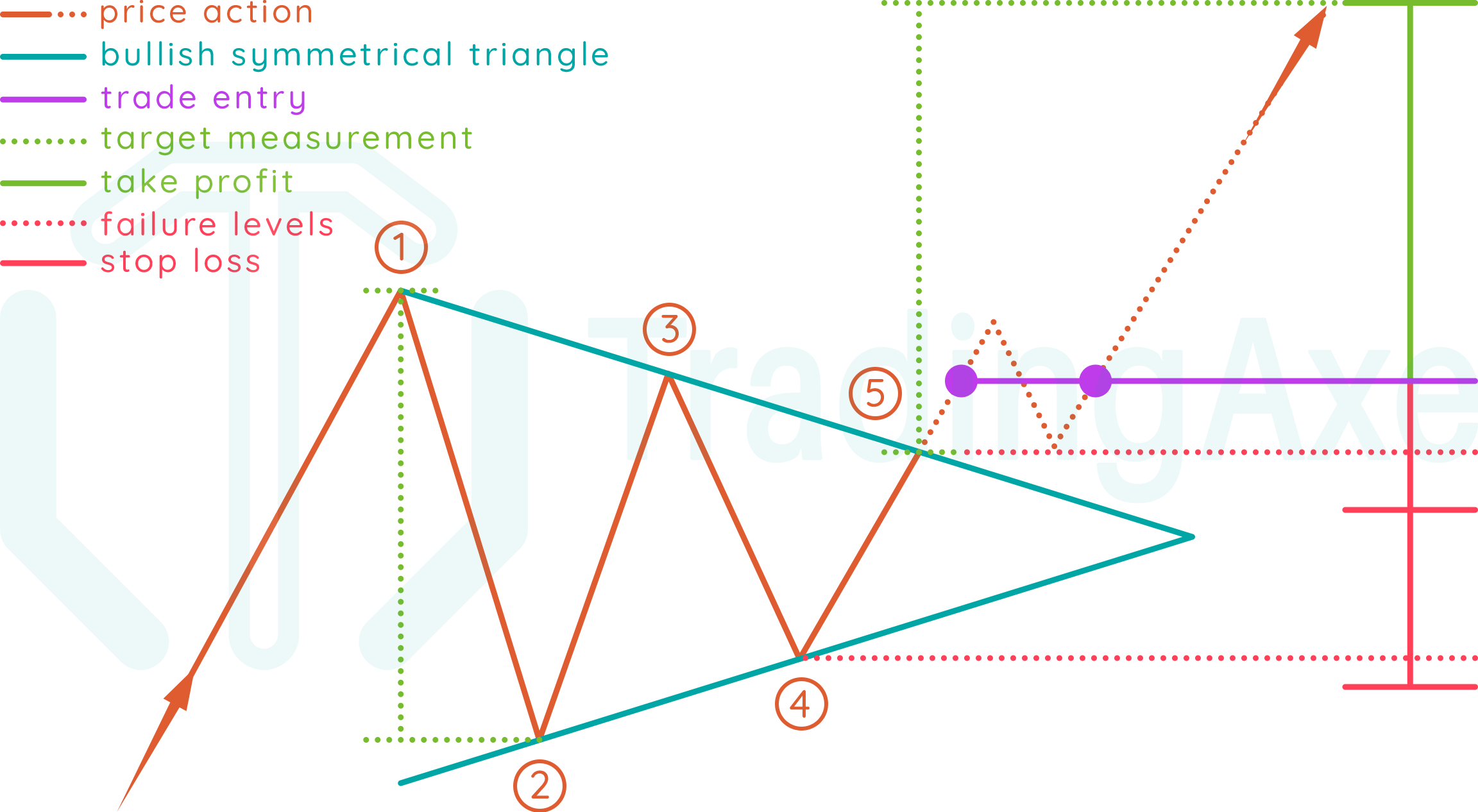

Step #1: Noticing Lower Highs and Higher Lows Step #2: Check to See If the Prevailing Trend Is Moving Upwards Step #3: Waiting for a Breakout to Enter a Buying Order Step #4: Taking Profits at the Right Time Step #5: Placing a Protective Stop Loss Conclusion Symmetrical Trading Pattern Video Symmetrical Trading Pattern PDF Download

The Symmetrical Triangle Trading Strategy

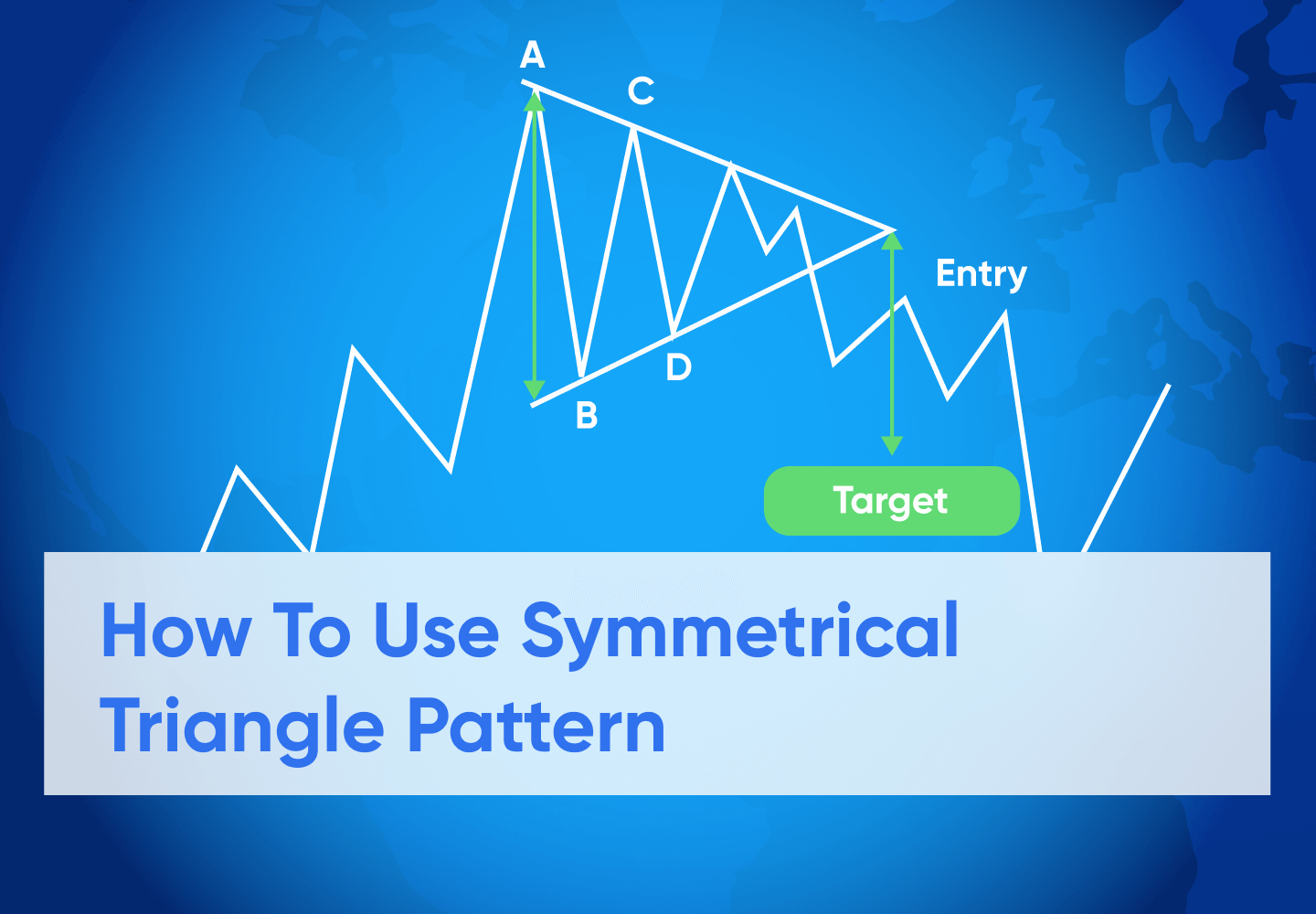

The symmetrical triangle is a technical analysis chart pattern that represents price consolidation and signals the continuation of the previous trend. It is one of the most common triangle chart patterns and is widely used by technical traders to identify entry and exit points.

Triangle Chart Patterns Complete Guide for Day Traders

The symmetrical triangle is a consolidation chart pattern that occurs when the price action trades sideways. It's considered to be a neutral pattern, as two trend lines are converging until the intersection point.

What Is Symmetrical Triangle Pattern Formation & Trading ELM

Symmetrical Triangle Chart Pattern Symmetrical Triangles: Important Bull Market Results Overall performance rank for up/down breakouts (1 is best): 36 out of 39/34 out of 36 Break even failure rate for up/down breakouts: 25%/37% Average rise/decline: 34%/12% Throwback/pullback rate: 62%/65%

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

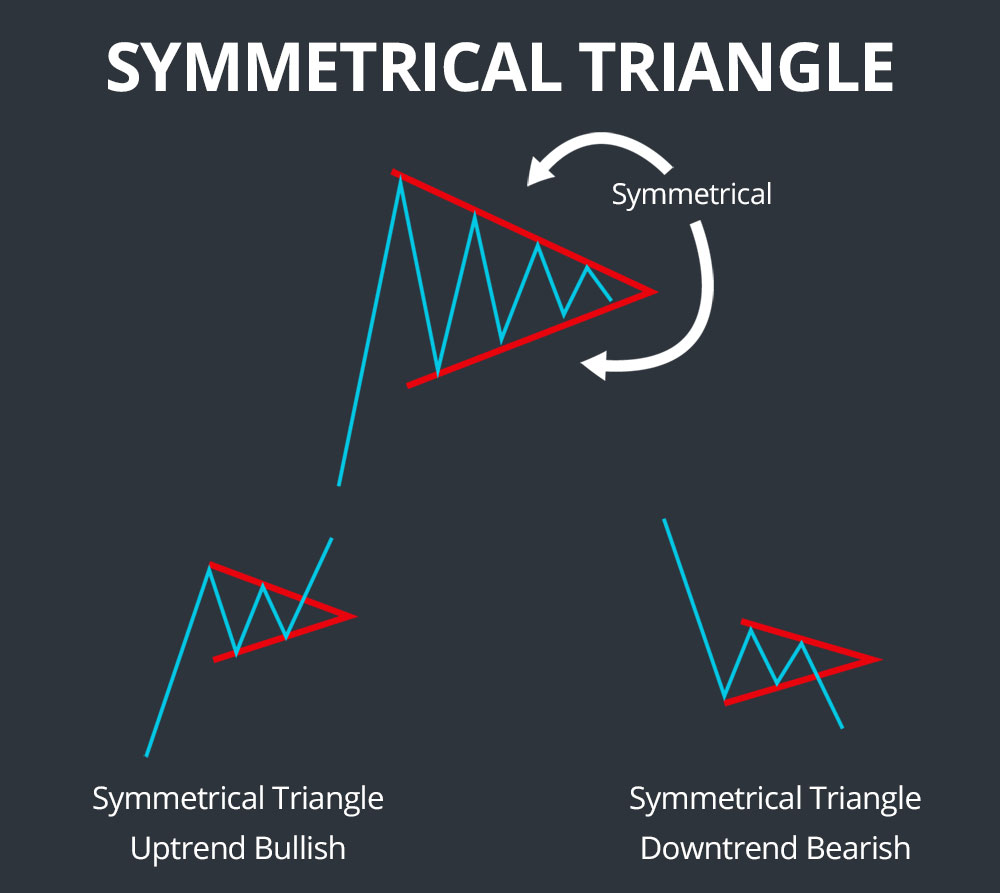

A symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. These trend lines should be converging at a roughly equal slope.

Symmetrical Triangle General Patterns ThinkMarkets

The symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern. The pattern contains at least two lower highs and two higher lows. When these points are connected, the lines converge as they are extended and the symmetrical triangle takes shape.

Symmetrical Triangle Pattern A Price Action Trader's Guide ForexBee

The symmetrical triangle pattern is a continuation chart pattern like Ascending and Descending Triangle patterns. This pattern is characterized by two converging trend lines that connect a series of troughs and peaks. The trend lines should be converging to make an equal slope.

What Is Symmetrical Triangle Pattern Formation & Trading ELM

Triangle: A triangle is a technical analysis pattern created by drawing trendlines along a price range that gets narrower over time because of lower tops and higher bottoms. Variations of a.

Symmetrical Triangle Pattern Definition & Interpretation Angel One

Pattern What is a symmetrical triangle pattern? A symmetrical triangle is a neutral technical chart pattern that consists of two converging trendlines. One trendline consists of a series of lower highs, acting as resistance. The other trendline consists of a series of higher lows, acting as support.

Symmetrical Triangle Pattern Bearish () Green & Red Bearish

A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Pennants are continuation patterns where a period.

Triangle Pattern Characteristics And How To Trade Effectively How To

What is a Symmetrical Triangle? Triangle patterns are probably the most popular chart patterns studied by traders. There are three different types of triangles: The ascending triangle, the descending triangle, and the symmetrical triangle. Symmetrical triangles occur when price is consolidating in a way that generates two converging trend lines with similar slopes. It is called "horizontal.

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns3_2-6eb5b82169aa45859c5696835f97244f.png)

Triangles A Short Study in Continuation Patterns

Symmetrical Triangle: A. 2 4 CHARTIST TRIANGLES: HOW DOES IT WORK? ANSWER is HERE! EURUSD , 1D Education 08:01 Le-Loup-de-Zurich Jan 5 ASCENDING TRIANGLE: Identify the levels where the price has often closed and opened (black line). The price is making higher and higher lows. Draw a bullish diagonal.

Symmetrical Triangle Chart How to Trade Triangle Chart Patterns

The symmetrical triangle pattern is a prevalent chart pattern observed in various financial markets, giving traders insight into the future price direction. This triangle chart pattern is formed when a security's price action converges, creating a series of lower highs and higher lows.

Symmetrical Triangle Chart Pattern Formation Example StockManiacs

A symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. These trend lines should be converging at a roughly.