Suburban computer paycheck calculator TheodoreTahab

Suburban New Style Computer Board. 521114 CaravansPlus

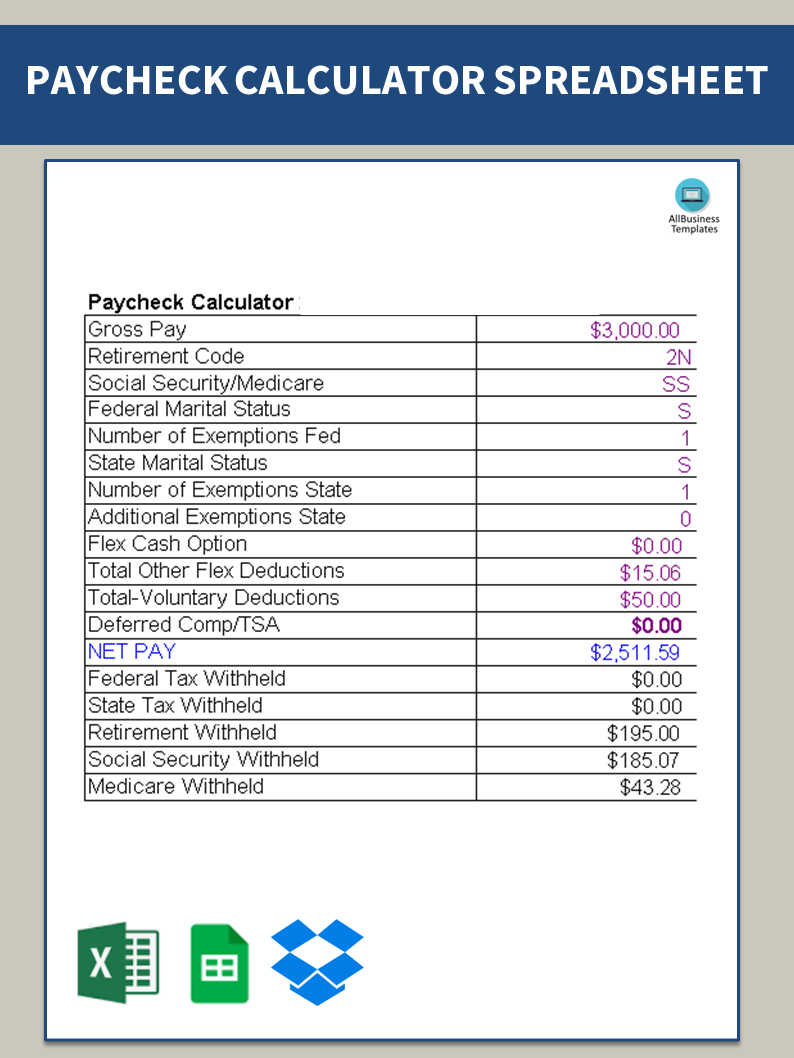

In Minnesota, as in every other state, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes, every pay period. Your employer will match those contributions and the total contribution makes up the FICA taxes. Earnings that exceed $200,000 are subject to a 0.9% Medicare surtax.

Suburban computer paycheck calculator TheodoreTahab

Federal Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Select a state Paycheck FAQs Switch to salary calculator

SUBURBAN COMPUTER TECHS 2370 Wexford Ln, Lake in the Hills, Illinois

Our intuitive 401 (k) Calculator helps you plan for your future. Use this calculator to see how increasing your contributions to a 401 (k) can affect your paycheck and your retirement savings. The Form W-4 Assistant tool will take you step-by-step through the process of filling out a Form W-4.

Suburban paycheck calculator NikolaPolly

No State Income Tax Additional payroll withholding resources: Federal withholding tax table Paycheck Calculator Paycheck Withholding Changes Withholding Tax Primer

to Suburban Computer Services Payroll, Computer service

Paycheck calculator. This easy to use calculator will help you determine your take home pay. Withholding Tax Primer. Step by step instructions on how to manually calculate Federal withholding taxes based on IRS Circular E. State withholding tax tables. Employer withholding tables for all 50 states Cloud backup services.

Suburban paycheck calculator MehreenAela

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay. Don't want to calculate this by hand? The PaycheckCity salary calculator will do the calculating for you.

One Paycheck Calculator Multiple Uses Free Pay Stub Generator

Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Overview of Missouri Taxes. Missouri has a progressive income tax rate that ranges from 0% to 5.30%. Missouri's two largest cities, Kansas City and St. Louis, also collect.

Payroll tax calculator suburban computer Kairasolekhah

tool Salary paycheck calculator Payroll Tax Salary Paycheck Calculator How much are your employees' wages after taxes? This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide.

Suburban computer paycheck

Unlimited companies, employees, and payroll runs for 1 low price. All 50 states including local taxes, and multi-state calculations. Federal forms W-2, 940 and 941. Use PaycheckCity's free paycheck calculators, withholding calculators, and tax calculators for all your paycheck and payroll needs.

Paycheck & Tax Withholding Calculator, Your Pay Stub or Check

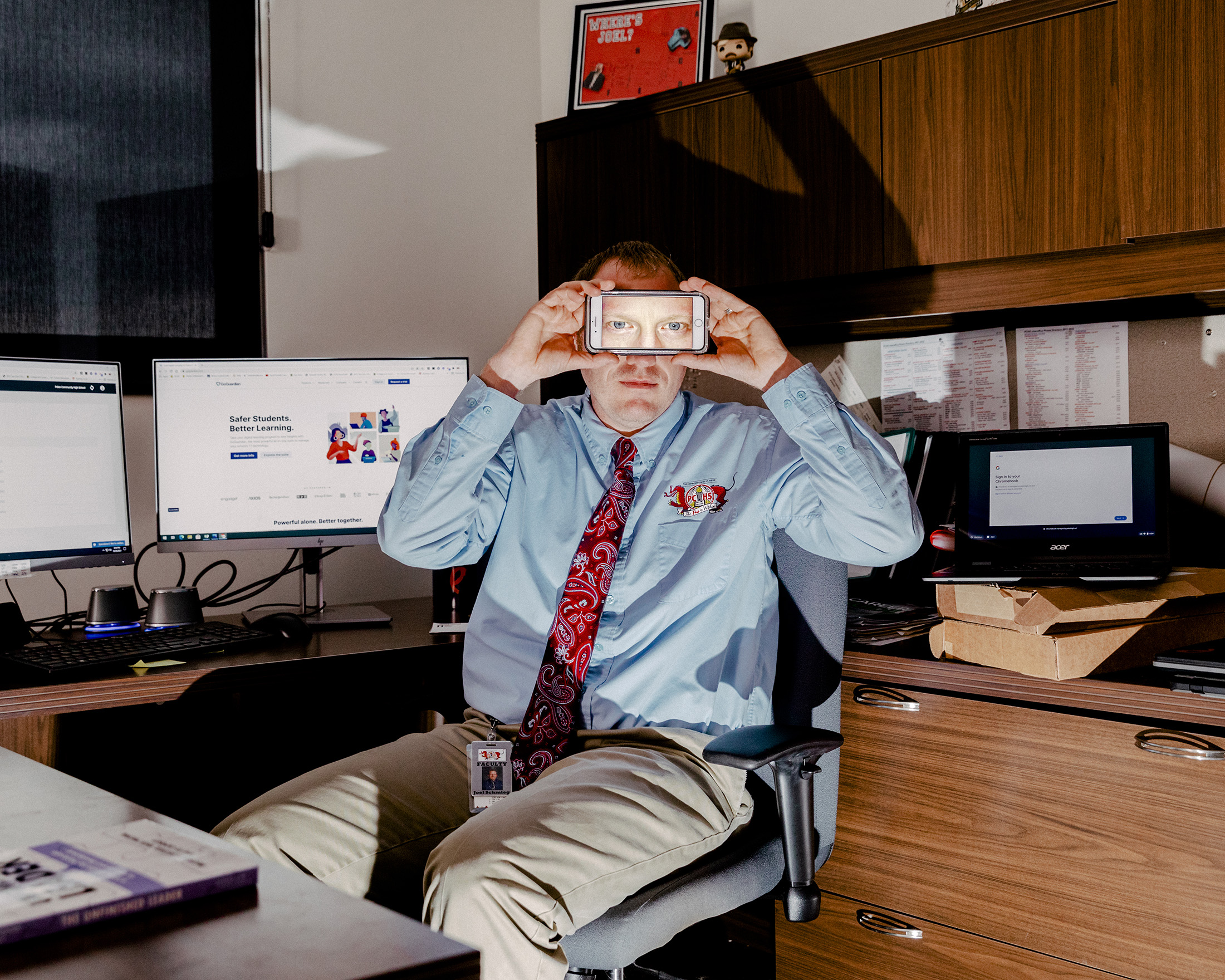

Suburban Computer Services (SCS) has been providing computerized accounting solutions to small businesses since 1981. The majority of our clients are from Metropolitan Detroit, but others can be found nationwide from California to Delaware.

Suburban computer paycheck calculator TheodoreTahab

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U.S. residents. The calculation is based on the 2024 tax brackets and the new W-4, which, in 2020, has had its first major.

Paycheck Calculator Gratis

This is the gross pay for the pay period before any deductions, including wages, tips, bonuses, etc. You can calculate this from an annual salary by dividing the annual salary by the number of pay.

Suburban computer paycheck calculator TheodoreTahab

Paycheck calculator for Missouri. Overview of Missouri. Missouri has over 6 million (2020), and its major industries include aerospace, food processing, chemicals, printing/publishing, electrical equipment, and beer. The median household income is $53,578 (2017), lower than the national median of $61,372.

Payroll tax calculator suburban computer Kairasolekhah

Multiply your Gross Pay by your Pay Frequency resulting in your Annual Gross Pay . Federal Withholding Calculation (based on IRS Circular E, January 2015), and found on my Federal Withholding page. Multiply your Federal Exemptions (as claimed on Line 5 of your 2015 Federal W4) by $4,000.00. This is your Federal Exempt Wages.

Payroll tax calculator suburban computer EwanSilver

The final weekly pay calculator on our list comes from Suburban Computer. The biggest benefit to their weekly income tax calculator/paycheck calculator is that it is simple and fast. There are significantly fewer areas to enter information. This means you may not get as detailed of a response, but you can use it quickly.

Take Home Paycheck calculator Plan your budget well in advance before

This free hourly and salary paycheck calculator can estimate an employee's net pay, based on their taxes and withholdings. Get an accurate picture of the employee's gross pay, including overtime, commissions, bonuses, and more.