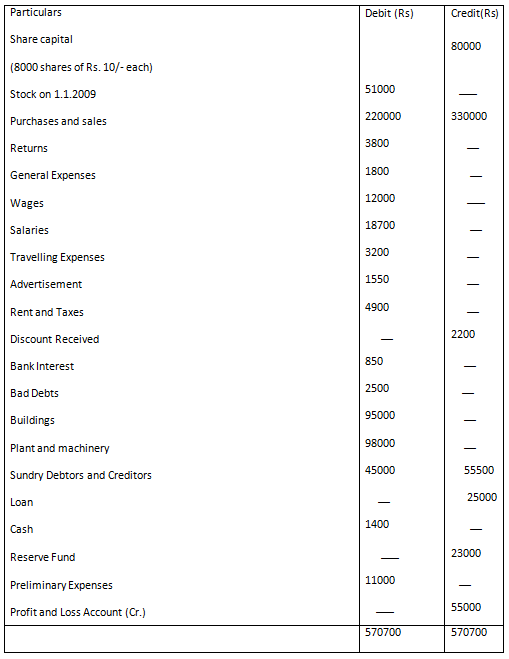

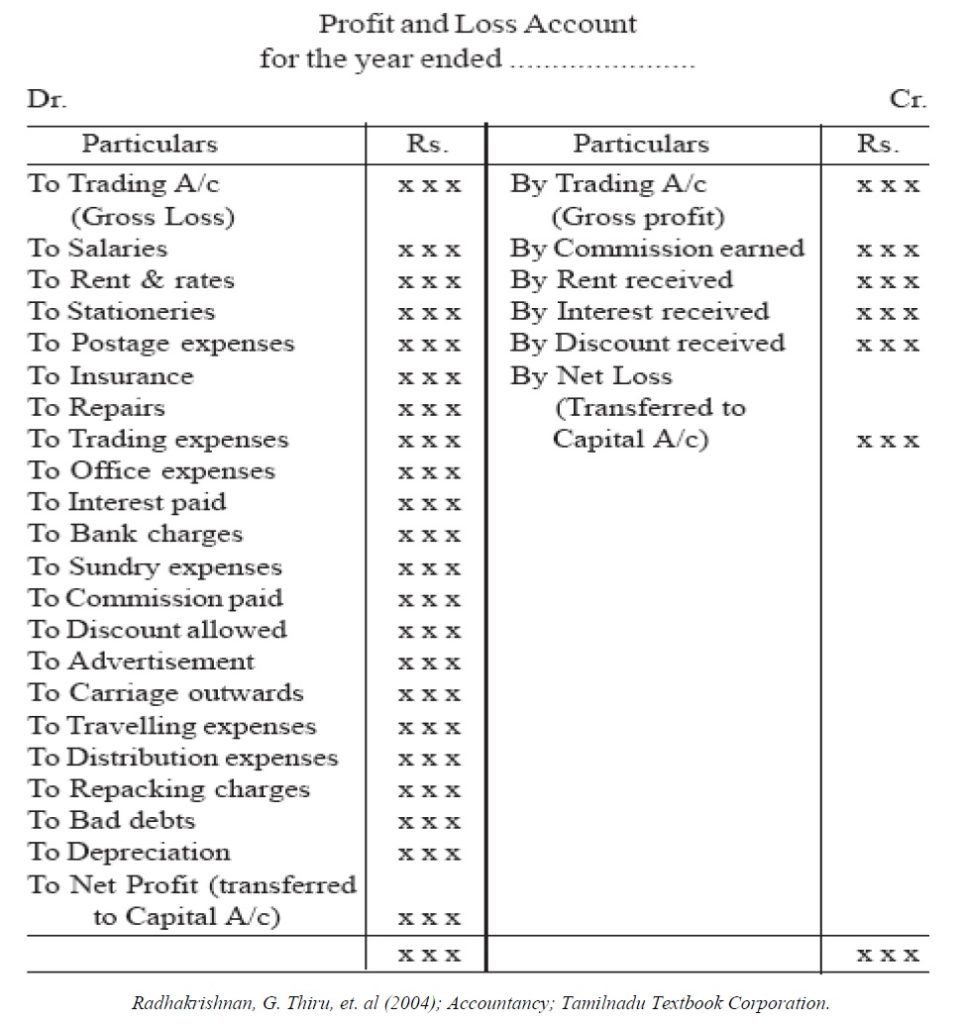

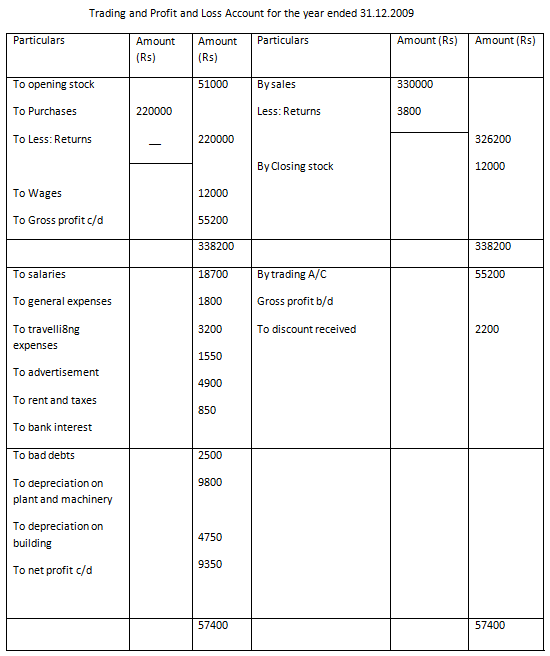

Final Accounts, Trial Balance, Financial Statements

Final Accounts, Trial Balance, Financial Statements

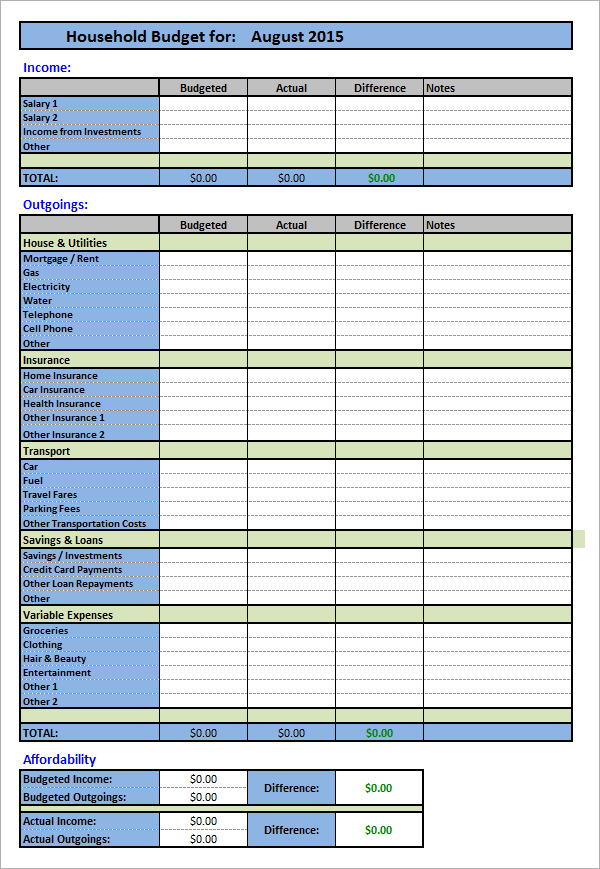

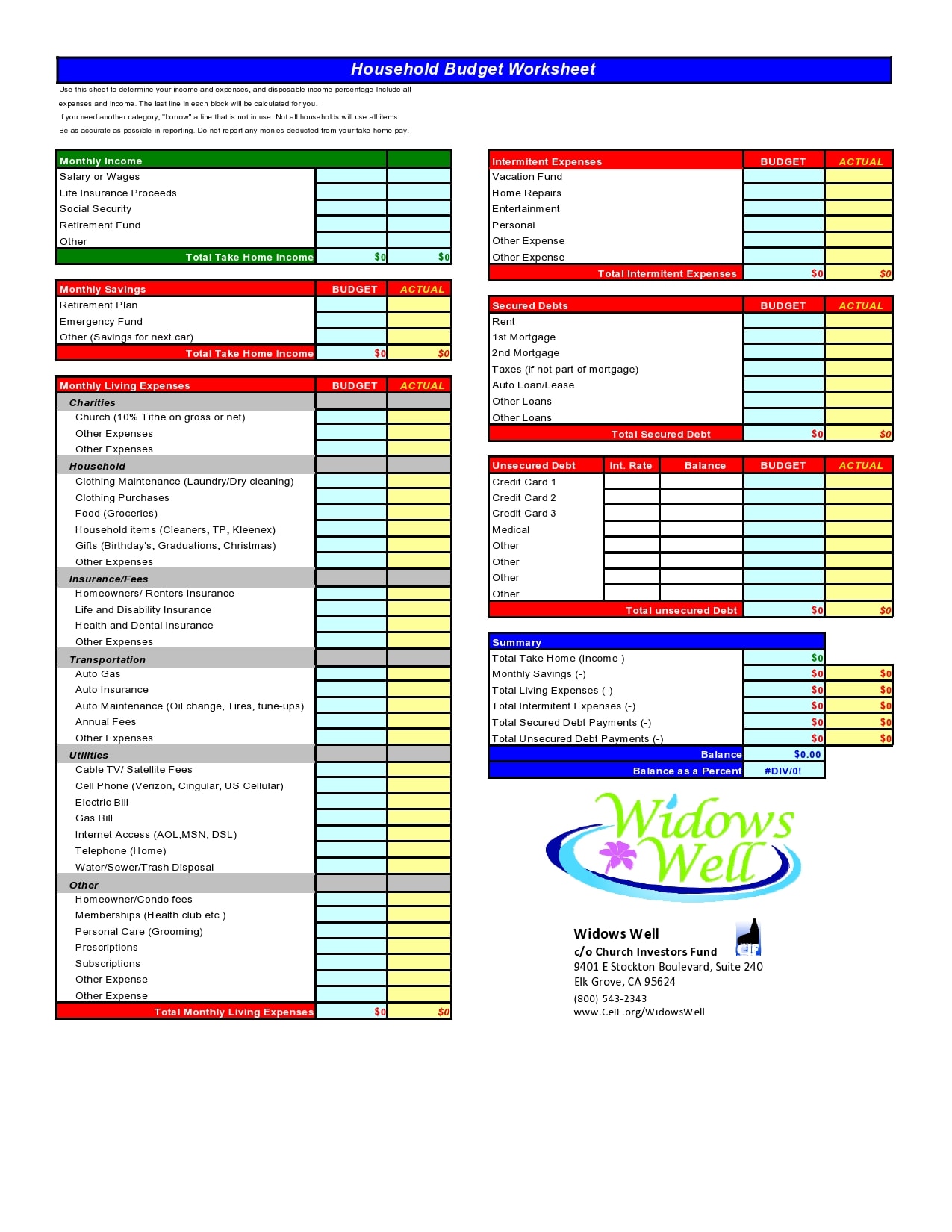

Add Up Your Expenses. Calculate Your Net Income. Adjust Your Expenses. Track Your Spending. Photo: JGI/Jamie Grill / Getty Images. Making a budget is a key piece of a strong financial foundation. Having a budget helps you manage your money, control your spending, save more money, pay off debt, or stay out of debt.

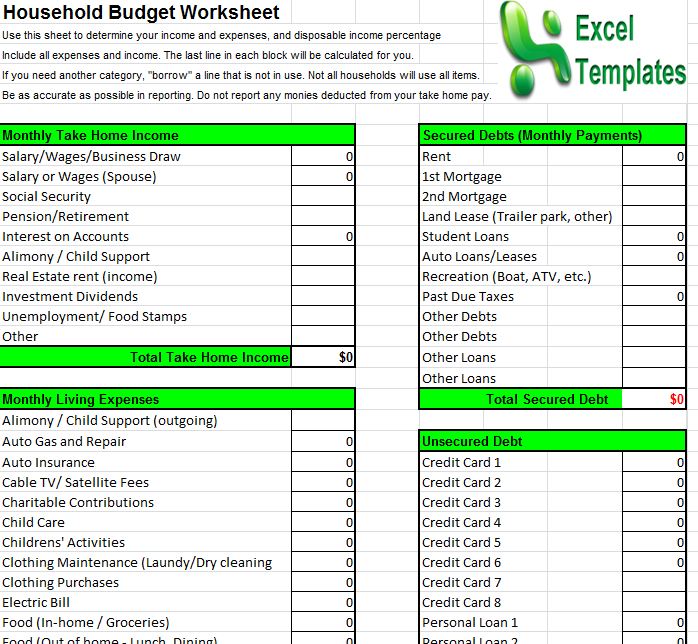

Free household budget template excel filnhe

Step 2: Make a list of all your monthly expenses (yes, even the easily forgotten ones). Step 3: Subtract your expenses from your income—and that number should equal zero. This method is called zero-based budgeting . Now, a zero-based budget doesn't mean you have zero dollars in your bank account.

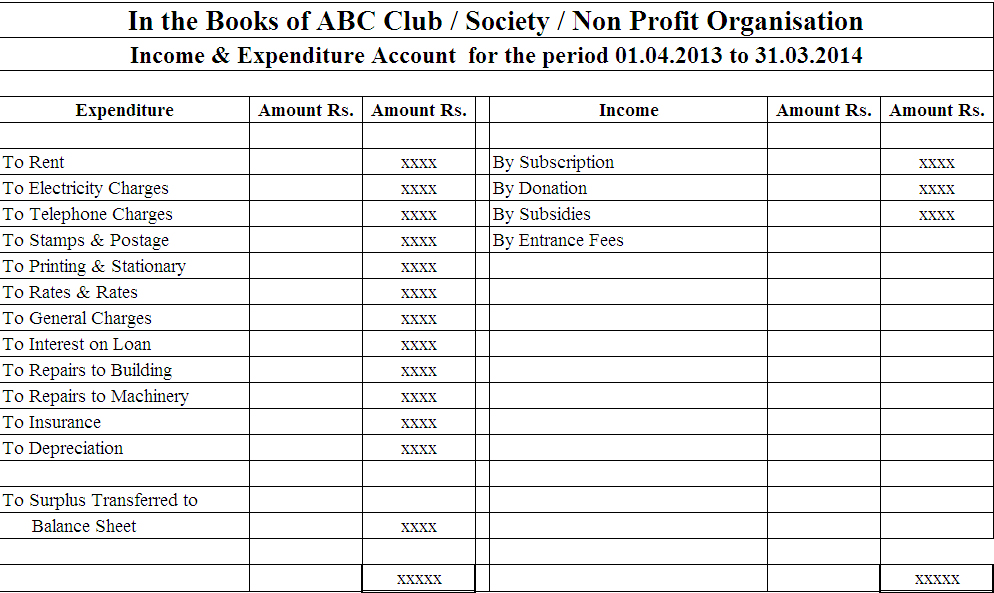

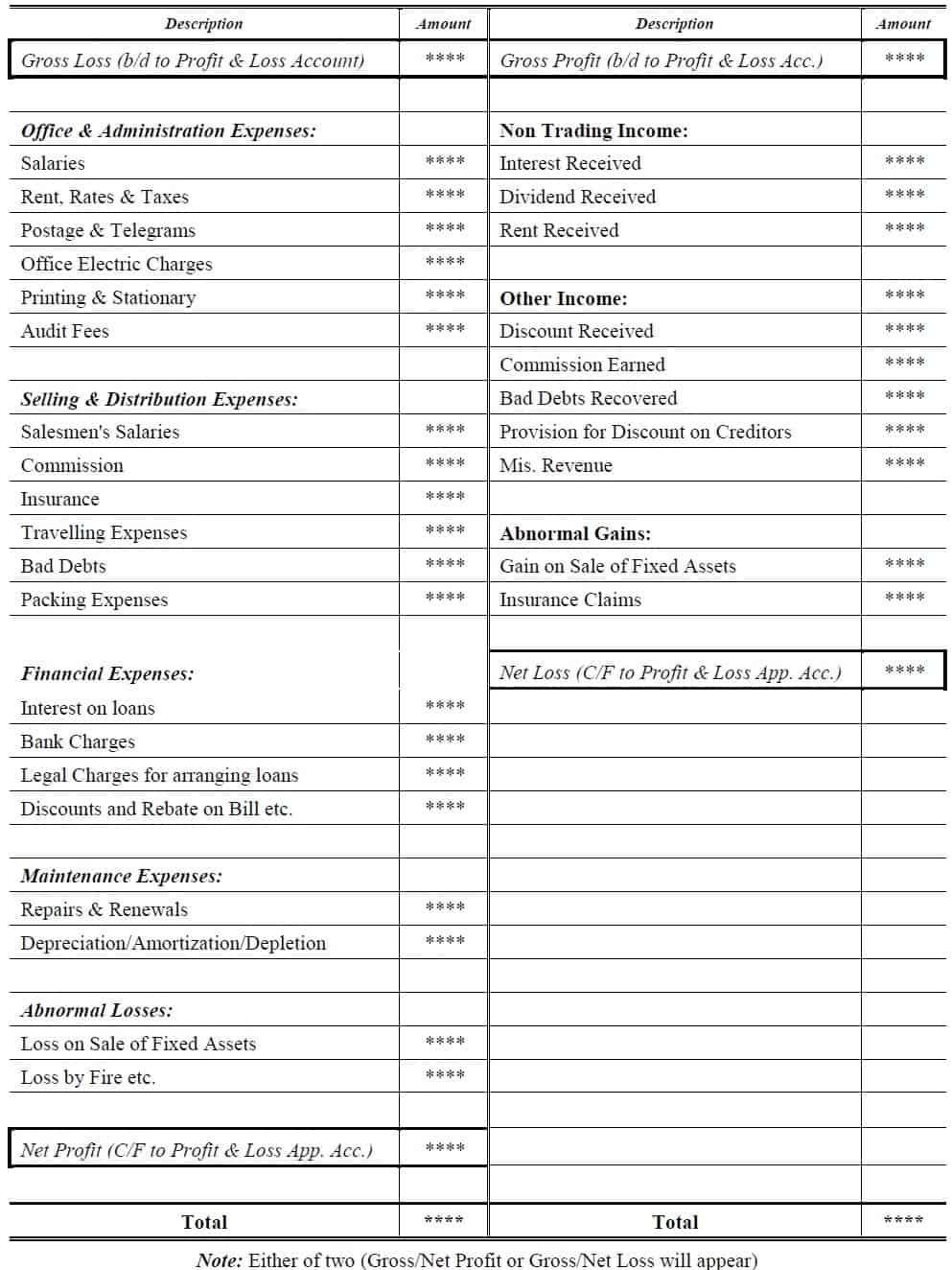

Final Accounts Financial Statements Accountancy Knowledge

Expenses divided by income should give you a percentage of 30%. "Therefore, 30% of your $3,000 a month take home or $900 goes into your account. 30% of the $7,000 which is $2,100 goes into their.

How to create a Household budget in Excel The Excel Club

updated Nov 28, 2022. American households spend an average of $61,334 per year, or $5,111 per month — 82% of our after-tax income. Most households have the same major expenses: housing, transportation, taxes and food make up 78% of our budgets. Understanding the average cost of living can help you create a budget and make good financial.

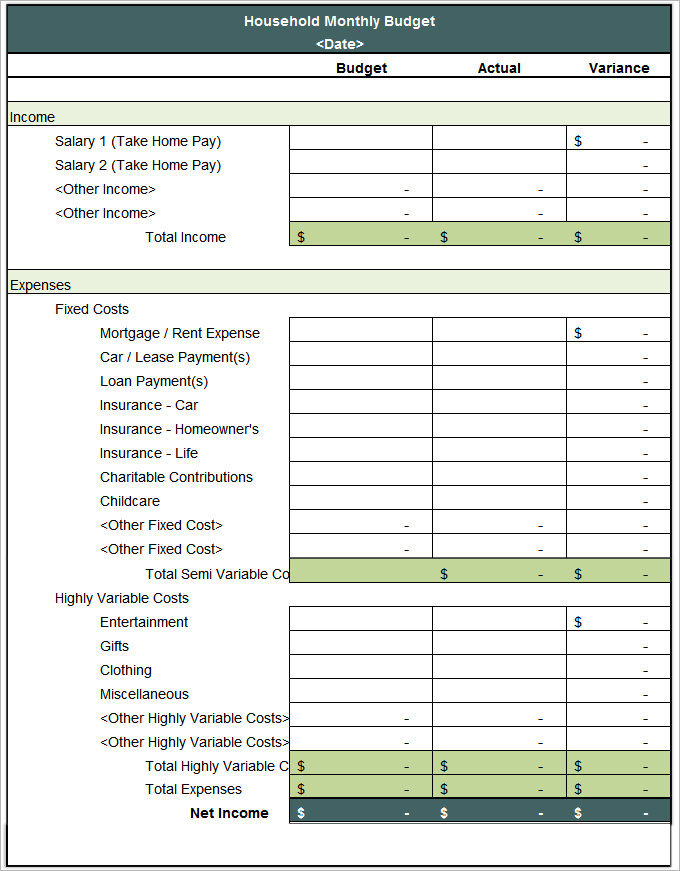

Sample Household Budget Spreadsheet —

It's important to confront your finances and create an effective household budget to help you get a grasp on your finances and limits. Follow these tips to creating an effective budget for your home and family: 1. Get a Clear Idea of Your Spending Habits. You might have an idea of how much you spend each month, but without cold-hard math, you.

Household Budget Template Household Budget Calculator

published June 18, 2020. A good budget helps you reach your spending and savings goals. Work out a proposed household budget by inputting your sources of income and projected expenses into.

Final accounts 2

Health insurance is one way that people can pay for routine medical expenses and protect against the financial burden of large, unexpected expenses. In 2021, 91 percent of adults had health insurance, a slight uptick from 2020. Those without health insurance were nearly twice as likely to forgo medical treatment because they couldn't afford it.

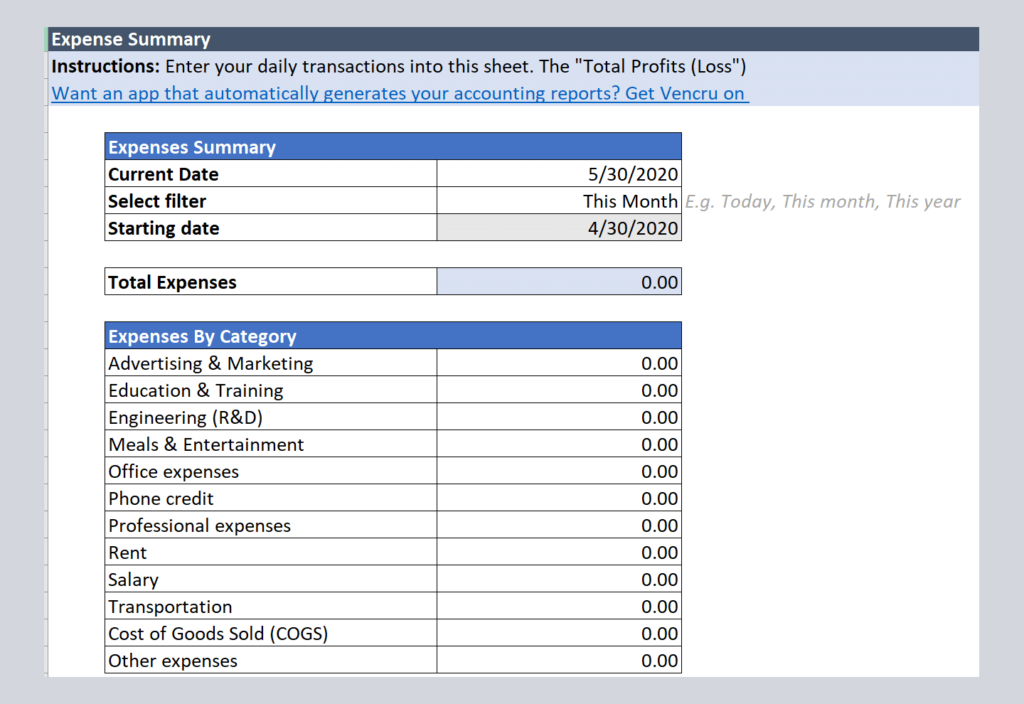

Expense Report Template Vencru

Household expenses are the essential costs of running a home. Common types of household expenses include rent and mortgage payments, utilities, cell phone bills, and groceries. Knowing exactly what household expenses are and when they're due can potentially help people stay on top of their budget, take control of spending, and plan for the.

Final Account Statements Let us share knowledge

Review Your Expenses and Close Accounts. One of the first steps in simplifying your budget is reviewing your bank statements and identifying all your expenses. Categorize them into "unnecessary" expenses (like unused subscriptions) and "necessary" expenses (like utilities) so you can make decisions about where to cut back.

Final Accounts Definition and Explanation Tutor's Tips

1. Housing. Home expenses will include everything related to your home, including items such as: Your monthly rent or mortgage payment. Maintenance costs such as landscaping, replacement light bulbs, etc. Repair costs such as a need for a new vacuum, furnace, flooring, etc.

Simple home budget spreadsheet imaginedamer

Create a balanced budget. Many financial experts advise people to allocate their budgets using the 50-30-20 method.Fifty percent of your take-home income should go toward basic living expenses.

Final Accounts, Trial Balance, Financial Statements

Household expenses represent a per person breakdown of general living expenses. It includes the amount paid for lodging, food consumed within the home, utilities paid and other expenses. The sum.

Comprehensive home budget spreadsheet lalapaana

A family budget is a plan for your household's incoming and outgoing money. Try the 50/30/20 method, and explore tools like worksheets and apps.

Final Accounts Financial Statements Accountancy Knowledge

These accounts grow tax-free and can be used tax-free for qualified education expenses. As for retirement, a traditional 401(k) or IRA offers an immediate tax deduction on contributions .

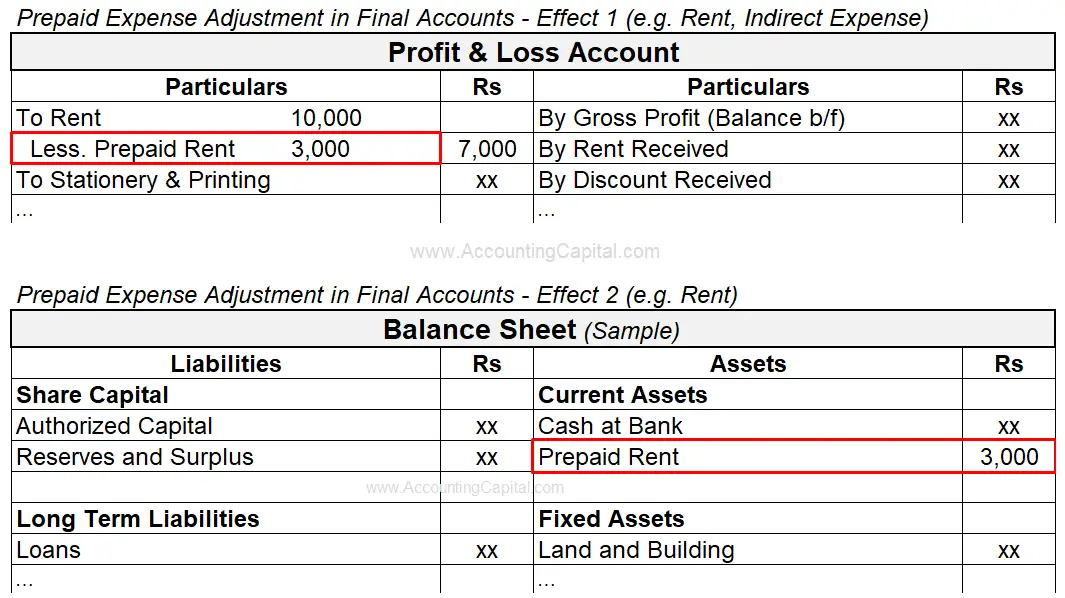

Adjustments in Final Accounts (Examples, Explanation, More..)

Step 2: Add Your Income. Click "Tell us your monthly income" which will take you to a page where you input your monthly income. If you have your bank accounts connected to the Mint app, this will auto-populate. Once finished, click "Done-now add expenses".

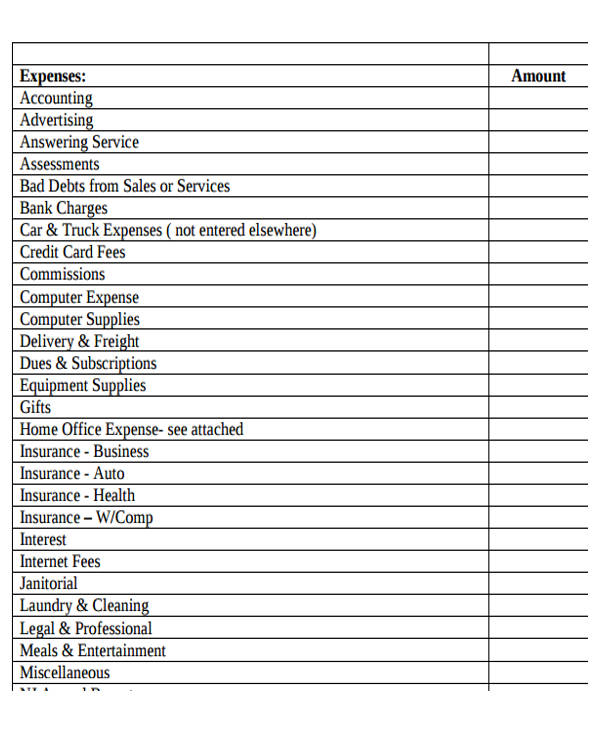

FREE 10+ Sample Lists of Expense in MS Word PDF

Key Takeaways. Common household expenses include mortgage payments, transportation, food, health care, and child care costs. You can create a budget to cut down on expenses and reduce impulse buying and overspending. Eating out at restaurants less can help significantly reduce your food costs.